Employee turnover, which is the rate at which employees leave a company and are replaced, includes both voluntary exits (quits, resignations) and involuntary exits (layoffs, discharges, etc.). Understanding current turnover trends is essential because the U.S. labor market in 2024-2025 continues to evolve through post-pandemic shifts, rising living costs, hybrid/remote work expectations, and varying economic pressures.

Most important employee turnover statistics

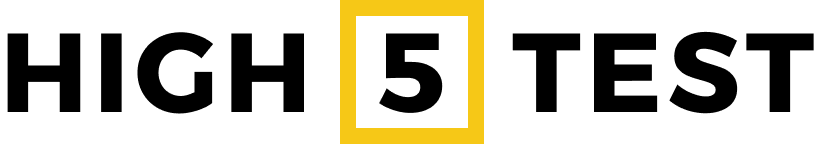

- Voluntary turnover rate in the U.S. for 2024–2025 is ~13.0 % (excluding retirees, volunteers, contractors) – down from 17.3 % in 2023 and slightly lower than 13.5 % in 2024.

- The total employer turnover rate in 2024 is 18 %, down from 26 % in 2022–2023.

- In July 2025, the monthly quit rate was 2.0 %, with 3.2 million quits; total separations (quits + layoffs etc.) for the month was ~3.3 %.

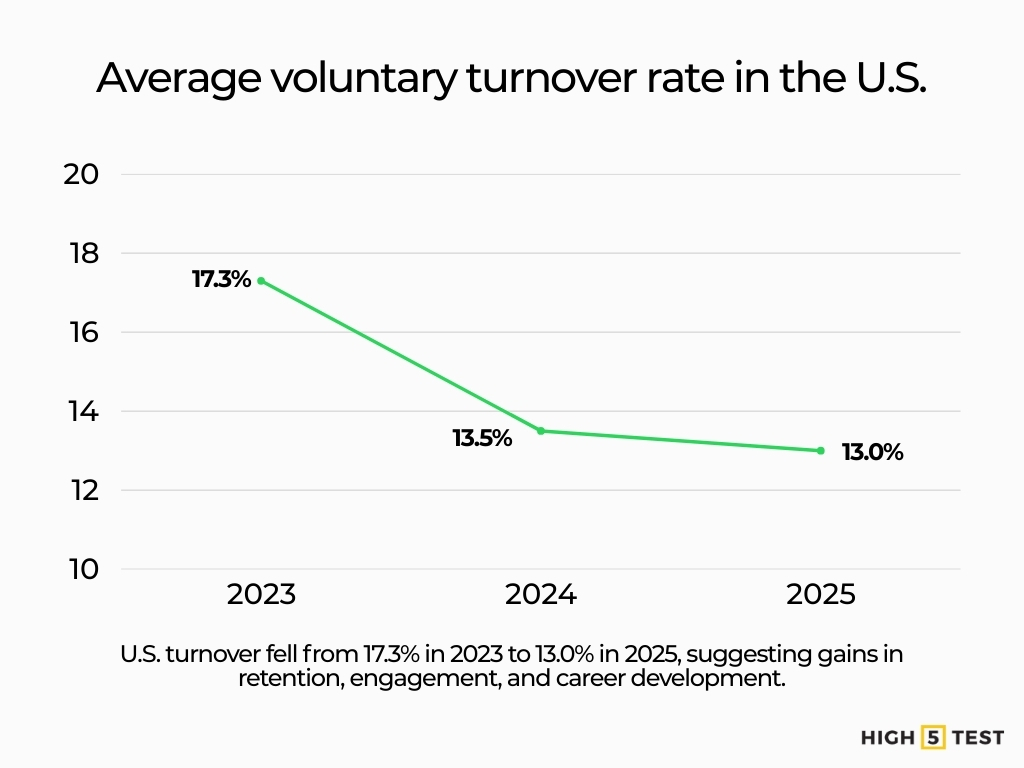

- Voluntary turnover by industry is highly variable – like Retail & Wholesale ~26.7 %, while Insurance / Reinsurance ~8.2 %.

- By job level, turnover is lowest for executives (5.2 %) and highest for “para-professional / blue collar” roles (12.5 %).

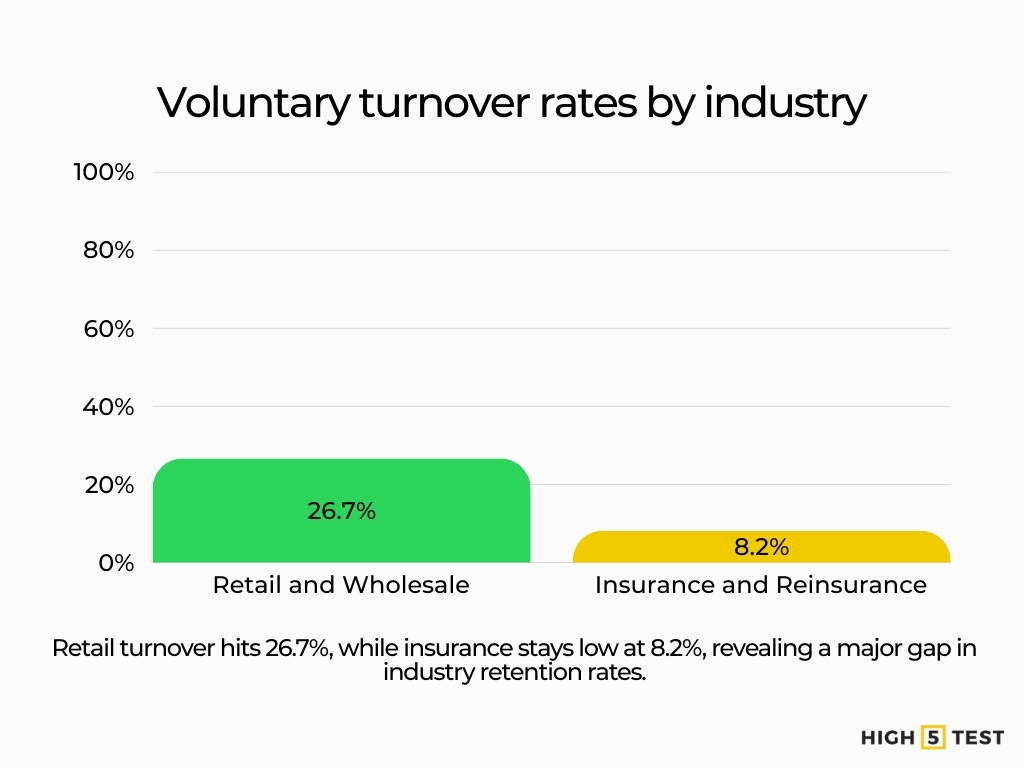

- 51 % of U.S. employees are “watching or actively seeking” new jobs.

- ~42 % of turnover is viewed by employees as preventable – like the organization or manager “could have done something” to retain them.

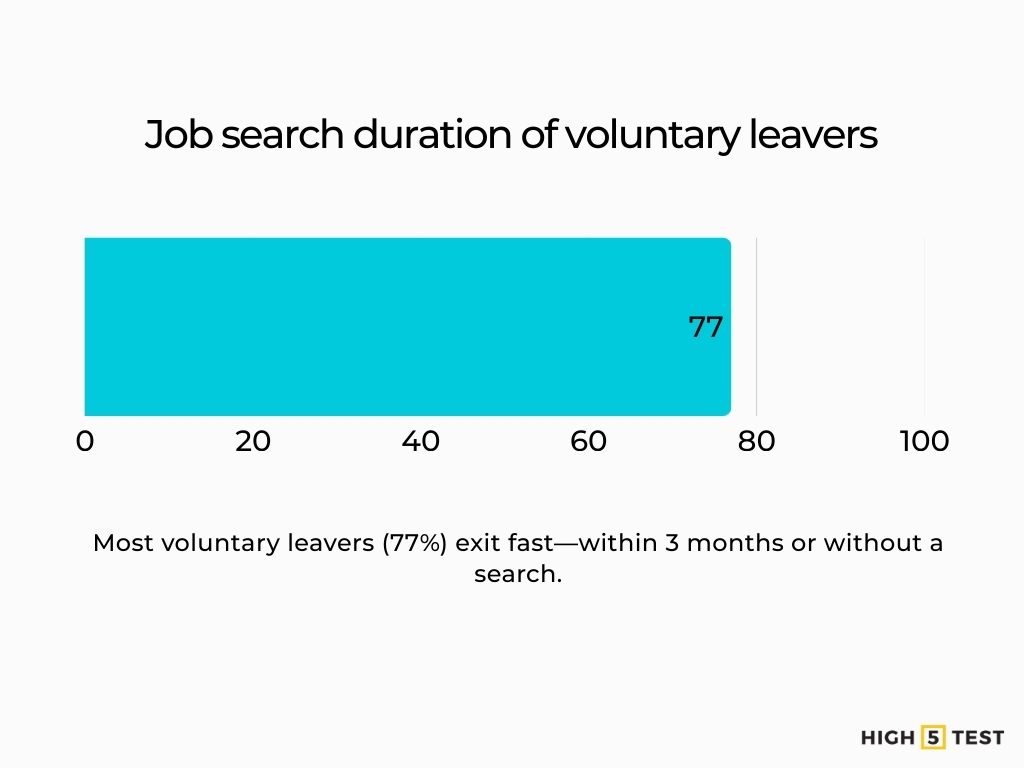

- 77 % of voluntary leavers either left within three months of searching or didn’t actively search before quitting.

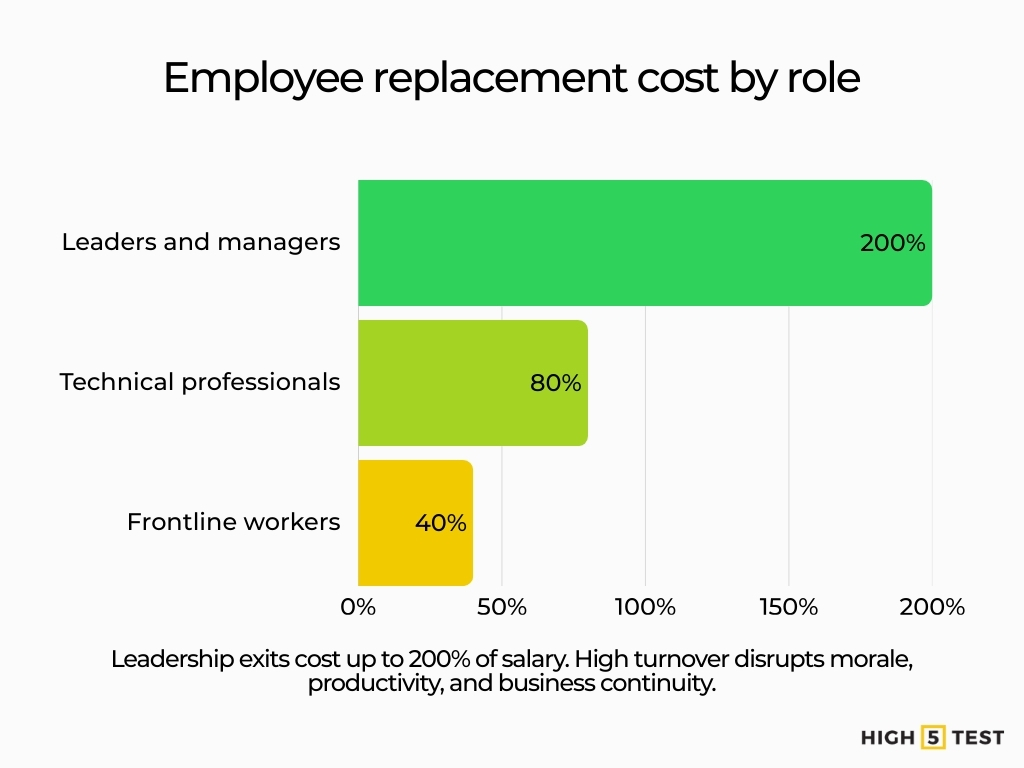

- The cost to replace an employee varies drastically by role: ~200 % of annual salary for leaders/managers, ~80 % for technical professionals, ~40 % for frontline workers.

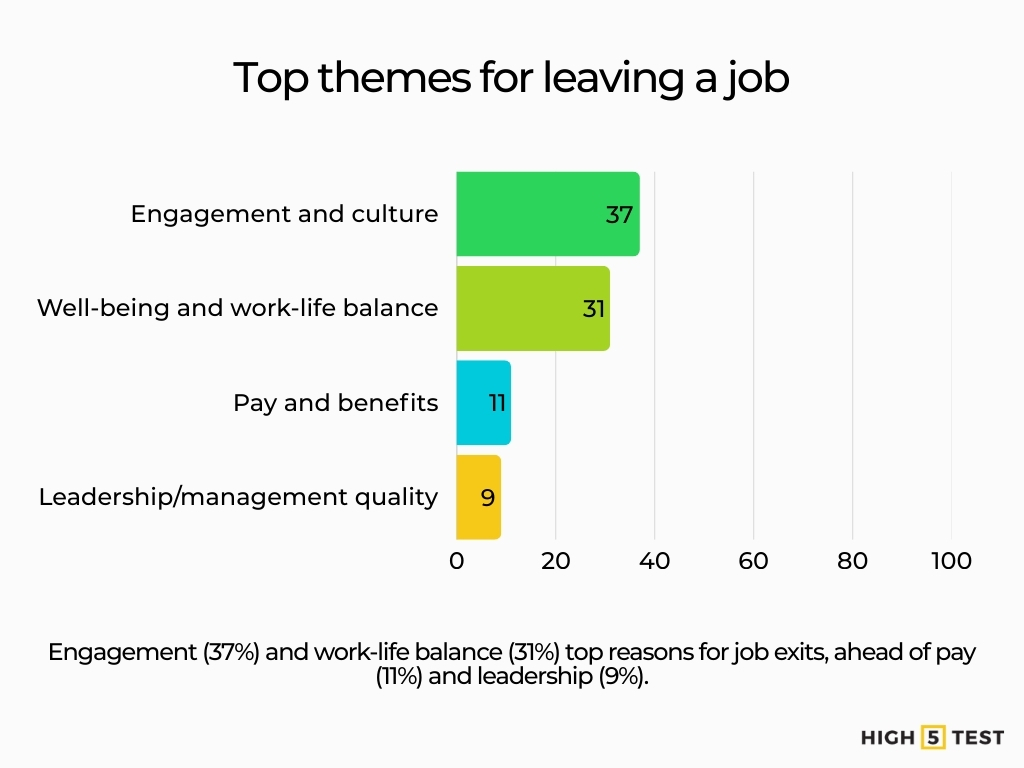

- Among top reasons cited for leaving: Engagement & culture (37 %), well-being / work-life (31 %), pay/benefits (11 %), leadership/management quality (9 %).

Key employee turnover metrics in the US

The average voluntary turnover rate in the U.S. for 2024–2025 stands at 13.0%, excluding retirees, volunteers, and contractors. This reflects a decline from 17.3% in 2023 and a slight drop from 13.5% in 2024. The drop could be a sign that employers are becoming more effective in retaining talent through better engagement, benefits, or career development programs.

Source: Imercers

The average total employer turnover rate in 2024 dropped to 18%, down from 26% in 2022-2023. This significant decrease suggests improved employee retention strategies or more stable workforce conditions across employers.

Source: Payscale

As of July 2025, the number and rate of quits were 3.2 million, with a quit rate of 2.0% per month. Total separations rate (which includes quits, layoffs/discharges, etc.) was also 3.3% in that period.

Source: Bureau of Labor Statistics

Stats on employee turnover by industry

Voluntary turnover is highest in the Retail and Wholesale sector, reaching 26.7%, while the Insurance and Reinsurance industry experiences one of the lowest rates at around 8.2%. This stark contrast highlights significant differences in employee retention across industries, possibly reflecting variations in job stability, compensation, and career development opportunities.

Source: Imercers

Turnover stats by job level and role

| Role / Level | Voluntary Turnover Rate |

|---|---|

| Executives / Heads of organizations | 5.2% |

| Management | 6.3% |

| Sales professionals | 7.3% |

| Non-sales professionals | 9.1% |

| White-collar professionals | 9.9% |

| “Para-professional Blue Collar” roles | 12.5% |

These data show that turnover increases as you move down the hierarchy (or toward roles with less seniority, more hands-on work, or less job security).

Source: Imercers

Turnover statistics by demographics and geography

Quit rate (monthly): In May 2025, the U.S. quit rate was 2.1%, up from 2.0% in April. That month saw 3.3 million workers quitting.

Source: Bureau of Labor Statistics

Geographic differences: States like Georgia and Virginia showed significant rises in quit rates in certain months, e.g., up by ~0.6 percentage points from April to May 2025.

Source: The Economic Times

Employee intent: 51% of U.S. employees are “watching or actively seeking” new jobs. This highlights a significant level of workforce dissatisfaction or restlessness, suggesting that employers may need to focus more on retention and engagement strategies.

Source: Gallup

Statistics on causes and drivers of turnover

Many employees cite compensation/benefits (16%), personal reasons (11%), and relocation (10%) as major motivators to leave or consider leaving.

Source: Gallup

Engagement and culture (37%), well-being and work-life balance (31%), pay and benefits (11%), and leadership/management quality (9%) remain the most common themes for leaving a job.

Source: Gallup

Around 42% of turnover is preventable, meaning employees believe their organization or manager could have done something to keep them.

Source: Gallup

There’s also a pattern of employees leaving without long job-search periods: 77% of voluntary leavers either left within three months of searching or didn’t actively search first.

Source: Gallup

Costs and impacts of employee turnover

Voluntary employee turnover is estimated to cost U.S. businesses close to a trillion dollars every year. Ignoring the causes of voluntary turnover can quietly drain resources over time.

Source: Work Institute

The cost of replacing an employee varies by role—approximately 200% of annual salary for leaders and managers, 80% for technical professionals, and 40% for frontline workers. Higher turnover damages morale, productivity, and continuity; plus, frequent hiring and training interrupt business operations.

Source: Gallup

Stats on preventability and retention strategies

Given that ~42% of turnover is viewed as preventable by the employees themselves, there’s a large opportunity for employer intervention.

Source: Gallup

Strategies that show promise include:

- Improving the organization’s work environment

- Foster a culture of belonging at work

- Offering competitive employee benefits

- Career growth and upskilling

- Creating an employee rewards and recognition program

Source: Bamboo HR

Seasonality and future outlook

Seasonal patterns remain: quits tend to be higher in certain months (often late spring/summer), though the latest monthly data shows relative stability in recent months (e.g., July 2025 quits unchanged at ~2.0% and separations ~3.3%).

Source: Bureau of Labor Statistics

Outlook for the remainder of 2025 into 2026: Voluntary turnover is expected to remain moderate, with potential for slight increases driven by ongoing economic pressures such as inflation and rising housing costs. However, retention efforts and hiring slowdowns in certain sectors are likely to help stabilize overall employee movement.

Risks include a possible economic downturn, growing dissatisfaction with remote work, and changes in labor market regulations. Opportunities lie in utilizing data and AI to forecast employee attrition, enhancing organizational culture, and offering compelling benefits to attract and retain talent. Balancing these risks and opportunities requires proactive workforce strategies, like taking self-assessment for leaders, and adaptive leadership to remain resilient and competitive.

FAQ

Is 20% staff turnover high?

Yes. In most industries, a 20% annual staff turnover rate is considered above average and potentially problematic. A 20% rate usually signals low employee engagement, poor onboarding, culture misalignment, or limited career growth.

Is a 30% turnover rate bad?

Almost always, yes. A 30% turnover rate means nearly one in three employees leaves each year, which creates heavy costs in recruitment, training, lost productivity, and morale.

What is a good employee turnover rate?

A good turnover rate is typically below 10% annually for most professional and corporate roles.

Conclusion

Voluntary turnover in the U.S. has slowed from the highs of the Great Resignation, but exit rates remain significant and continue to carry high costs. Employers should view turnover not merely as an HR metric but as a strategic cost center, especially given that data shows a large portion is preventable.

To reduce avoidable losses, organizations should focus on improving management quality, maintaining competitive pay, and strengthening early retention through onboarding and alignment with company culture. Flexible work options also remain an important factor in retention.

Survey data, exit interviews, and predictive analytics can help uncover risk patterns and highlight areas that need attention. Comparing these insights with industry benchmarks allows for more informed decisions. Finally, measuring turnover by role, geography, and tenure provides deeper insights than aggregate numbers alone, enabling more precise and effective retention strategies.