Student loan debt continues to be one of the largest and most impactful forms of consumer debt in the United States. As of 2024–2025, U.S. student loan balances exceed $1.6 trillion, affecting more than 40 million borrowers nationwide. With federal student loan payments resuming after years of pandemic-related relief, millions of Americans are facing renewed financial pressure, rising delinquency rates, and increased risk of default.

This research provides a comprehensive, data-driven overview of U.S. student loan debt statistics for 2024 and 2025, including total debt levels, average balances, borrower demographics, repayment performance, and recent policy changes. Using the most current data from authoritative sources such as the Federal Reserve, U.S. Department of Education, and independent research institutions, this report highlights key trends shaping the student loan landscape.

Whether you are a policymaker, researcher, journalist, or borrower, these insights offer a clear understanding of how student loan debt is evolving and what it means for the broader U.S. economy in 2025 and beyond.

10 most important student loan debt statistics

- U.S. student loan debt exceeded $1.6 trillion in 2025, making it the second-largest consumer debt category after mortgages.

- Over 40 million Americans currently hold student loan debt, meaning roughly 1 in 6 U.S. adults is a borrower.

- The average student loan borrower owes nearly $38,000 in 2025, despite the median balance being much lower—showing how extreme debt skews averages.

- Borrowers aged 50–61 hold the highest average balances (~$46,500), revealing that student debt is no longer just a “young person’s problem.”

- Graduate and professional degree holders carry the heaviest debt burdens, with:

- Law school graduates averaging ~$140,000

- Medical school graduates averaging ~$200,000

- Black borrowers are significantly more likely to take out student loans (66%) than White borrowers (47.4%), contributing to long-term racial wealth disparities.

- Although Black borrowers represent a smaller share of borrowers, they hold 14.55% of total student loan dollars—a disproportionate burden relative to population size.

- More than 9 million borrowers missed at least one payment after repayment resumed, signaling a sharp post-pause repayment shock.

- Approximately 9.6% of all student loan debt became 90+ days delinquent in 2025, up from under 1% during pandemic forbearance.

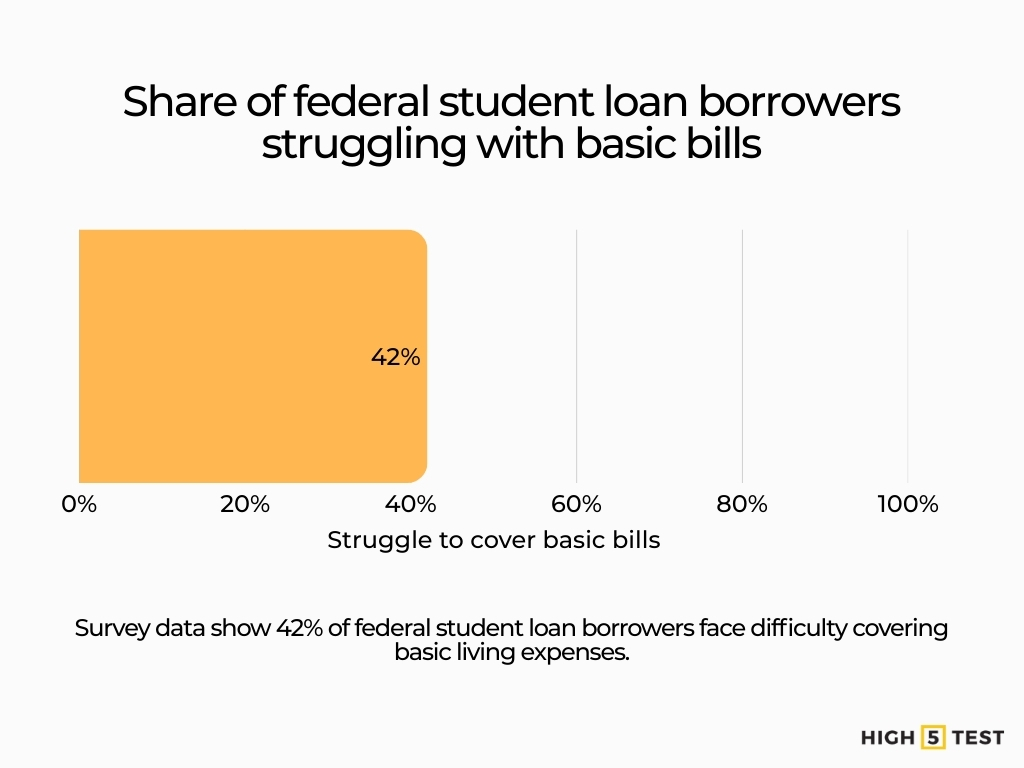

- Nearly 42% of federal student loan borrowers report struggling to cover basic living expenses such as rent, food, and utilities while repaying loans.

20 student loan debt statistics in the U.S. (2024/2025)

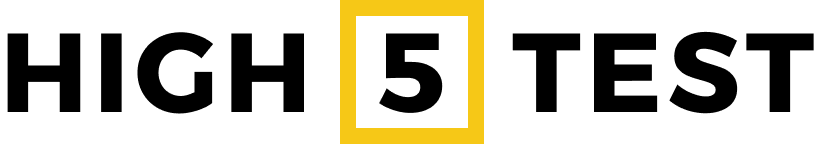

Total outstanding student loan debt in the U.S. reached approximately $1.64 trillion in mid-2025, a continuation of significant debt accumulation since the pandemic.

Source: Federal Reserve Bank of New York

Federal and private student loans combined were estimated at $1.81 trillion by Q2 2025, up 4.2% from the same quarter in 2024.

Source: Statista

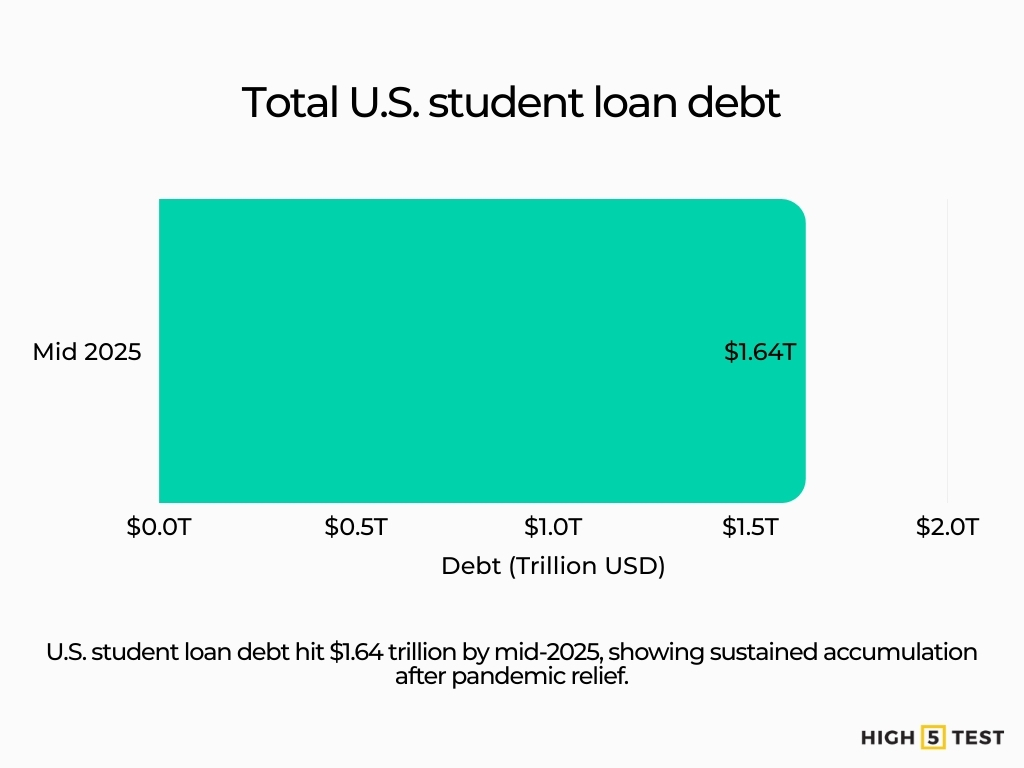

Federal loan debt accounts for roughly 92% of total student loan balances, with private debt making up the remainder.

Source: Education Data Initiative

Trend insight: Student loan debt continues to grow year over year, reversing the brief plateau seen earlier in the decade.

Data on borrower population and median debt

In 2024, the median student loan balance ranged from $20,000 to $24,999. Half of borrowers owed less than this amount, and half owed more.

Source: Federal Reserve

About 28% of borrowers owed less than $10,000 in 2024.

Source: Federal Reserve

It means that most borrowers hold moderate balances, even though high balance borrowers drive total debt growth.

Statistics on average student loan debt

In 2025, the national average student loan debt was around $39,000.

Source: CNBC

Borrowers aged 50–61 carried the highest average balance at around $46,556.

Source: Education Data Initiative

Borrowers under age 25 held about 5.56% of total federal student loan debt. Their balances were lower on average.

Source: Education Data Initiative

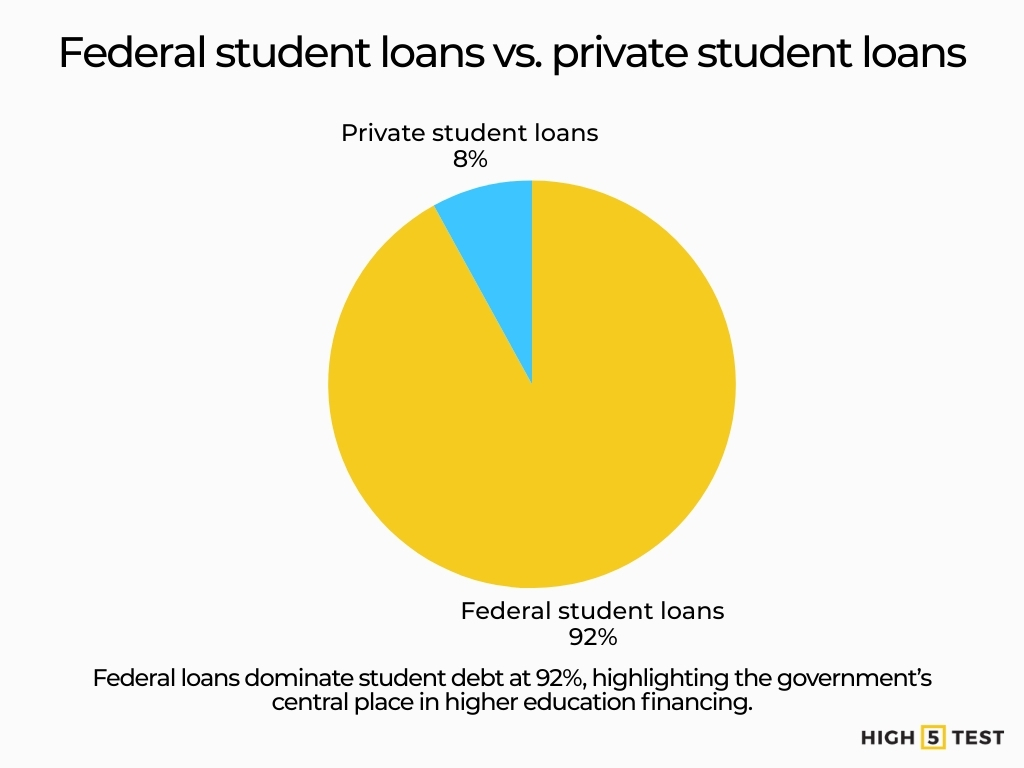

Graduate and professional degree holders owe significantly more:

- Master’s degree borrowers average ~$66,000

- Law school graduates average ~$145,000

- Medical school graduates average ~$246,000

Source: National Center for Education Statistics

Student loan debt is concentrated among older borrowers and those with advanced degrees.

Data on the demographic breakdown of students who have debts

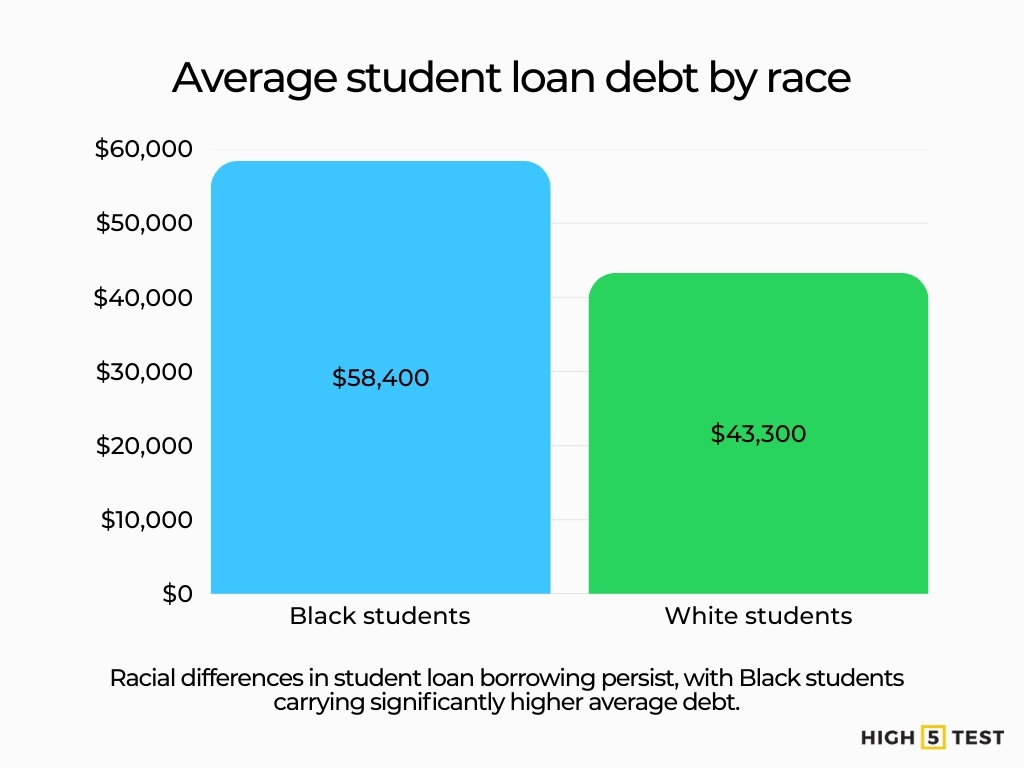

By race and ethnicity

Black students borrowed an average of $58,400, which was higher than the average amount borrowed by those who were White ($43,300).

Source: National Center for Education Statistics

14.55% of total loan money goes to Black borrowers, compared with 54.5% to White borrowers.

Source: Education Data Initiative

Independent research shows Black and Hispanic borrowers are more likely to struggle with repayment than White peers, contributing to higher default risk.

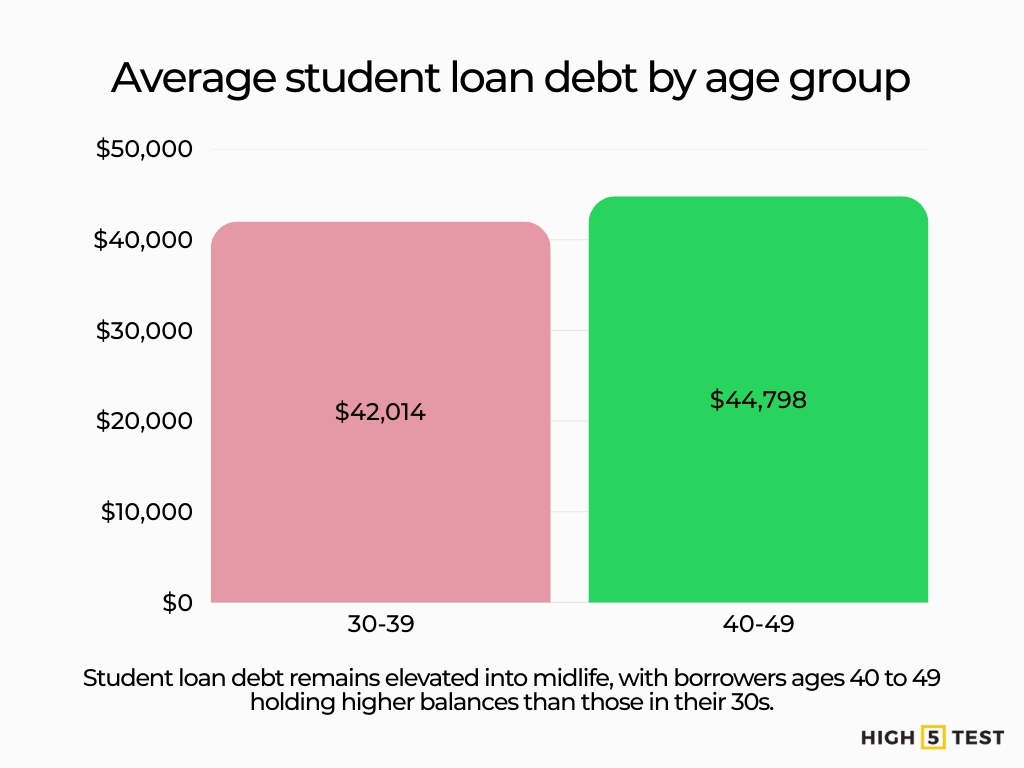

By age

30–39 year olds average around $42,014 in student loans, and 40–49 year olds average about $44,798.

Source: Education Data Initiative

Young adults under 30 represent 28.3% of borrowers (14.8 million) but often hold smaller balances on average.

Source: Education Data Initiative

Debt burdens tend to rise with age as balances accumulate and repayment stretches over time.

Statistics on repayment status and delinquency

As of 2025, more than 9 million borrowers have missed at least one student loan payment, marking a significant delinquency surge after repayment resumed.

Source: Financial Times

Approximately 9.6% of all student loan debt was more than 90 days delinquent, a steep increase from below 1% during pandemic relief.

Source: Financial Times

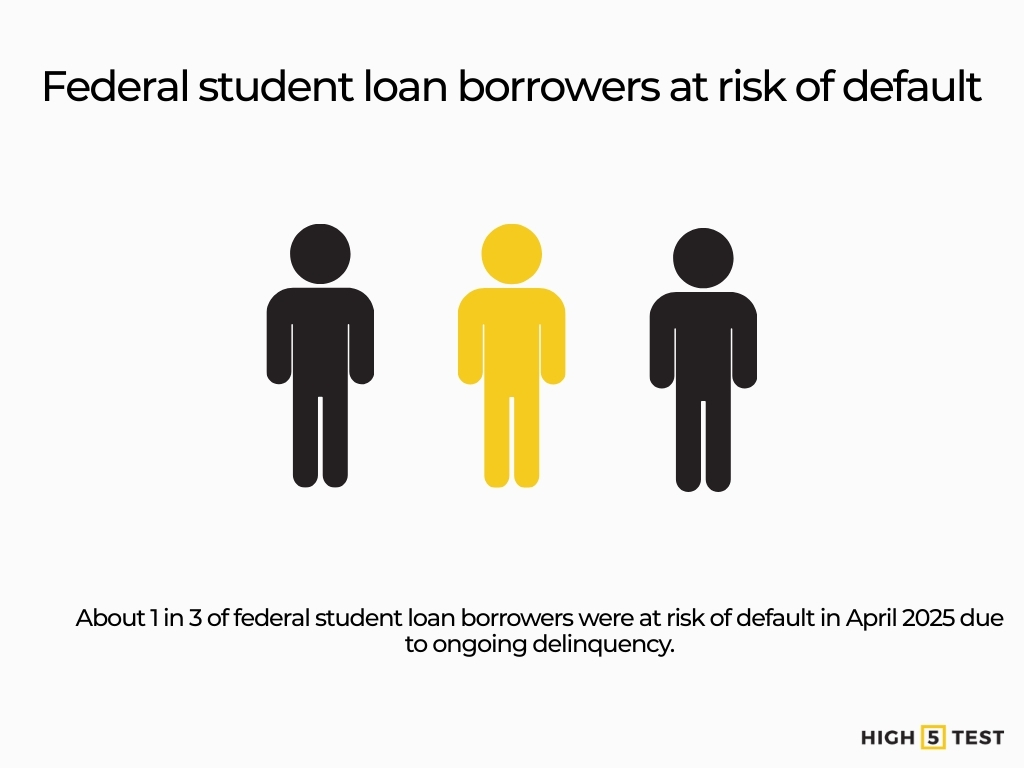

Another analysis found nearly one in three federal borrowers (31%) were at risk of default by April 2025 due to delinquency.

Source: TransUnion

Default and collections

Roughly 5.3 million borrowers (totaling about $117 billion) were already in default in early 2025, with collections slated to resume full enforcement and wage garnishment. Default typically occurs after 270 days without payment.

Source: Congress

Data on economic impact

A survey in 2025 showed 42% of federal student loan borrowers struggle to cover basic bills like food and housing, increasing default risk.

Source: CNBC

Delinquencies and defaults can lead to credit score damage, impacting credit access and long-term financial opportunities.

Source: CNBC

Policy and repayment programs for student loans

The SAVE repayment program ended after assisting more than 7 million borrowers with lower monthly payments.

This policy change added uncertainty to repayment options and may affect borrower outcomes through 2026.

Source: U.S. Department of Education

Comparison to other debt types

Student loans remain the second largest form of consumer debt in the United States. Mortgage debt ranks first, while auto loans and credit card debt remain smaller in total value.

Source: Education Data Initiative

Conclusion

Student loan debt remains a major financial pressure in the United States. Data from 2024 and 2025 show rising balances, renewed repayment strain, and growing delinquency after payments resumed. The burden falls unevenly across borrowers, with older adults, graduate degree holders, and some racial and economic groups carrying higher balances and facing greater repayment difficulty.

Total student loan debt is projected to continue rising moderately in 2026, driven by interest accrual and continued repayment activity. Borrower counts may decline slightly even as balances grow, suggesting consolidation and forgiveness efforts impact the overall population.

These trends point to broader economic effects beyond individual borrowers. Missed payments damage credit and household stability, while policy changes have added uncertainty to repayment options. Student loan debt continues to shape financial security, consumer behavior, and long-term economic outcomes, making sustained data tracking and clear policy direction essential.