HR outsourcing in the United States is accelerating as organizations seek cost efficiency, compliance support, and access to advanced HR technology. According to the latest HR outsourcing statistics for 2024 and 2025, the U.S. HRO market continues to grow steadily, driven by digitization, AI adoption, and increasing workforce complexity. From payroll and benefits administration to recruitment process outsourcing (RPO) and multi-process HR BPO, American companies are expanding their reliance on external HR providers to scale operations and reduce administrative burden. This research-backed overview examines verified HR outsourcing statistics in the U.S., including market size, growth projections, adoption rates, and emerging trends shaping 2025 and beyond.

This article compiles verified data from 2024 and 2025 market research to address three practical questions:

- How large is the HR outsourcing market?

- How widely do organizations outsource HR work?

- What do the latest pricing, technology, and risk trends mean for HR leaders planning 2025–2030?

10 most interesting HR outsourcing statistics

- The global HR BPO market generated ~USD 33.3 billion in 2024, showing HR services are a major slice of overall outsourcing spend.

- HR BPO market expected to reach ~USD 59.9 billion by 2030, a strong 10.5 % CAGR from 2025–2030.

- North America was the largest revenue-generating region in 2024, confirming the U.S. as the primary buyer region for HR BPO services.

- The U.S. HRO (Human Resource Outsourcing) revenue is projected at ~USD 13.3 billion in 2025, representing about 28 % of global HRO revenue.

- 72 % of surveyed leaders have outsourced work, confirming outsourcing as a mainstream operational model rather than an exception.

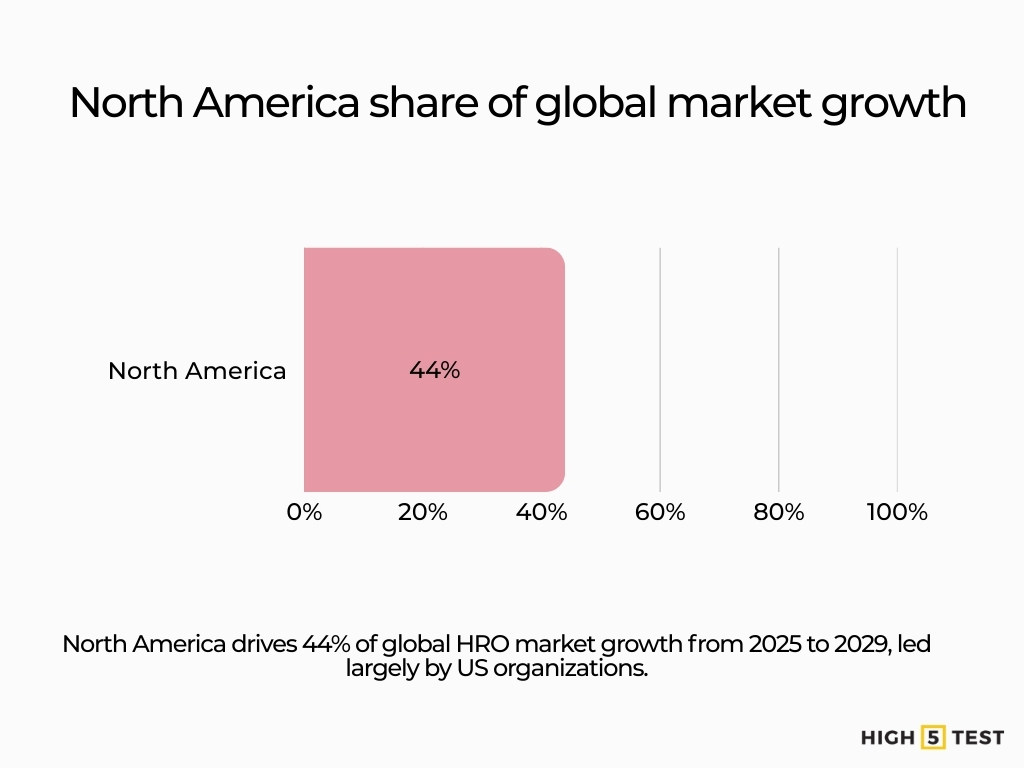

- 34 % of organizations outsource HR-related work, placing HR behind only finance and IT among outsourced functions.

- 93 % of organizations that outsourced reported satisfaction with the experience, highlighting strong execution when governance works.

- HR outsourcing administration fees have dropped 21 % over the last five years, driven by automation and competitive pricing.

- Global HRO market projected to grow by ~USD 14.1 billion between 2024 and 2029, with a 5.3 % CAGR – showing stable long-term demand.

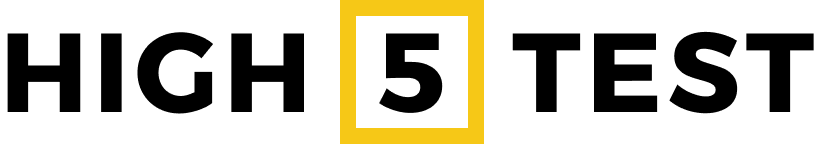

- North America is expected to contribute ~44 % of global HRO market growth from 2025–2029, positioning U.S. organizations as the central force shaping the industry.

20+ HR outsourcing statistics in the U.S. (2024-2925)

HR BPO revenue and data

The global HR BPO segment generated USD 33,322.9 million in revenue in 2024. This figure shows that HR services represent a major share of total outsourcing spend.

Source: Grand View Research

The market is projected to reach USD 59,887.2 million by 2030, reflecting a CAGR of 10.5% from 2025 to 2030. This growth rate signals strong demand tied to scale and automation.

Source: Grand View Research

North America was the largest revenue-generating region in 2024. This confirms the United States as the primary buyer region for HR BPO services.

Source: Grand View Research

| Market revenue in 2024 | USD 33,322.9 million |

| Market revenue in 2030 | USD 59,887.2 million |

| Growth rate | 10.5% (CAGR from 2025 to 2030) |

| Largest revenue-generating region | North America |

For U.S. HR leaders, this shows that HR outsourcing is not a fringe niche within BPO. It stands as one of the primary growth drivers in the broader outsourcing market, with North America and the United States leading in total value.

Dedicated HRO market: Global and U.S. revenue

A market report about the Human Resource Outsourcing (HRO) gives a more HRO-specific view:

Global HRO revenue:

| 2021 | 2025 | 2033 | Global CAGR (2025-2033) |

| USD 38,134.5 million | USD 47,225.9 million | USD 72,427.5 million | 5.491% |

This shows consistent growth rather than rapid expansion.

Source: Cognitive Market Research

North America HRO revenue:

| 2021 | 2025 | 2033 | CAGR (2025-2033) |

| USD 13,728.4 million | USD 16,694.4 million | USD 24,697.8 million | 5.017% |

North America continues to expand in line with global averages.

Source: Cognitive Market Research

United States HRO revenue specifically:

| 2021 | 2025 | 2033 | CAGR (2025-2033) |

| USD 10,982.8 million | USD 13,298.7 million | USD 19,494.0 million | 4.897% |

The US accounts for the majority of North American HRO spending.

Source: Cognitive Market Research

In 2025, the United States generated about USD 13.3 million in HRO revenue, representing 28.16 % of global HRO revenue.

Source: Cognitive Market Research

Growth is steady rather than explosive: High single-digit growth for HR BPO and mid-single-digit growth for HRO specifically.

Short-term growth outlook through 2029

An analysis of the Human Resource Outsourcing (HRO) Market provides the short-term forecast:

The global HRO market is expected to grow by USD 14.1 billion between 2024 and 2029, growing at a CAGR of 5.3% over that period. This increase reflects stable enterprise demand rather than short-term spikes.

Source: Technavio

With a base year of 2024 and YoY growth of 5.0% from 2024 to 2025. This aligns with broader enterprise services growth patterns.

Source: Technavio

North America is expected to contribute 44% of the global HRO market growth from 2025 to 2029. This positions US organizations as the primary drivers of future demand.

Source: Technavio

Almost half of incremental HRO growth through 2029 is projected to come from North America, positioning US organizations as the primary buyers and leading influences on global HRO market direction.

Statistics on organizations outsourcing HR

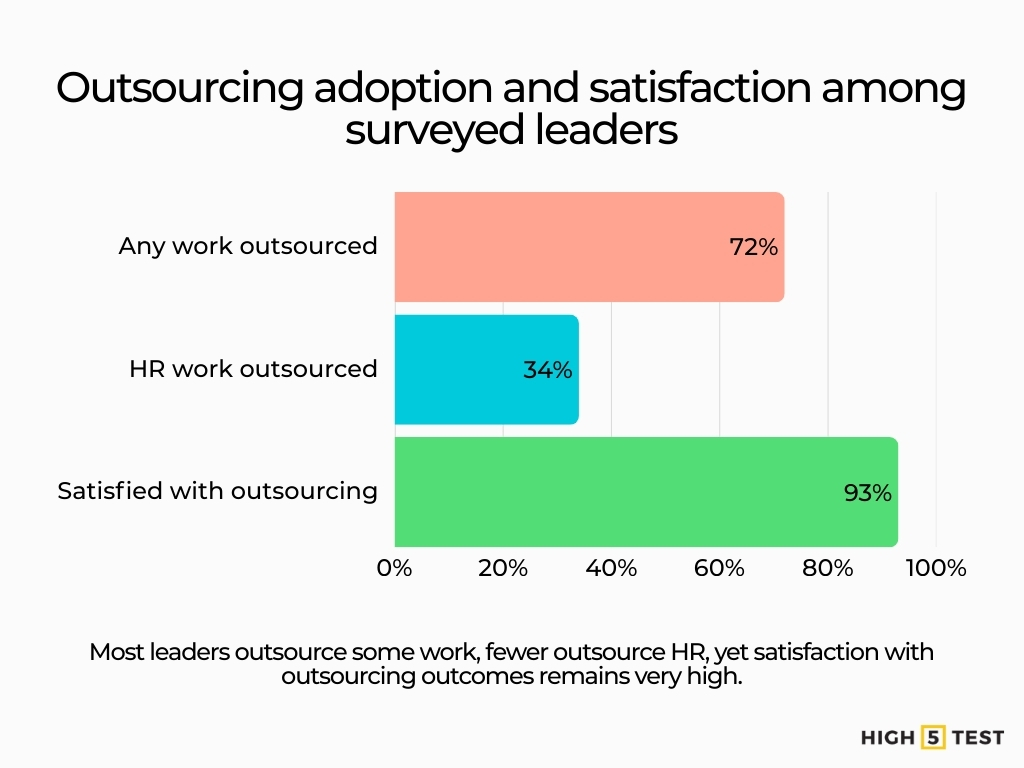

A report that surveyed 360 C-suite leaders across industries in 2024 found:

About 72% of leaders surveyed have outsourced work in the past. This confirms outsourcing as a standard operating model rather than an exception.

Source: Wipfli

Among these organizations, 47% outsourced finance and accounting, 46% outsourced technology work, and 34% outsourced HR-related work. This places HR behind finance and IT but ahead of many operational areas.

Source: Wipfli

93% of organizations that outsourced reported being satisfied with the experience. High satisfaction suggests that execution quality matters more than the decision itself.

Source: Wipfli

For HR leaders, the takeaway is clear. Outsourcing is now standard across U.S. enterprises, and about one in three organizations already outsource HR functions.

What this means for HR leaders

Since HR historically trails other functions in outsourcing maturity, a 34% adoption rate signals a clear shift. Many mid-sized and large organizations have moved past the initial decision stage.

A realistic benchmark for 2024 and 2025 is that about one-third of organizations with any outsourcing activity already outsource HR services.

Source: Wipfli

Statistics on what HR functions are being outsourced

Research reports that the HRO market is typically broken down by service type, which maps closely to what U.S. organizations use external partners for:

The HRO market is segmented into (among others):

- Payroll Outsourcing

- Benefits Administration Outsourcing

- Multiprocess Human Resource Outsourcing

- Recruitment Process Outsourcing (RPO)

- Learning Services Outsourcing

Source: Industry Research

In 2025, the U.S. HRO market will reach USD 13,298.7 million. Within a broader North American HRO revenue of USD 16,694.4 million. This indicates that the US generates more than 80% of regional revenue.

Source: Cognitive Market Research

Overlaying this with more data from another research (where more than a third of organizations that have outsourced HR, often alongside finance and IT) implies:

- Payroll and benefits administration are typically the first processes to be outsourced.

- RPO and learning services are increasingly part of multi-process HRO deals as organizations look beyond basic administrative tasks towards talent and capability building.

Source: Industry Research

The data on the cost and pricing of HR outsourcing

Cost remains a top concern for HR leaders evaluating outsourcing decisions. The clearest pricing insights come from firms that track outsourcing deals and fee structures across the market.

Administration fee trends

An insight for 2025 pricing-trends analysis for HR outsourcing reports that:

- HR outsourcing administration fees have decreased by 21% over the last five years. This decline reflects automation and standardized delivery.

- They are 10% lower over just the last three years. Buyers now negotiate more aggressively using market benchmarks.

Source: ISG

Interpretation:

- Even as the HRO market grows in absolute size, per-unit administration fees are declining by low double digits over multi-year periods. This shifts attention toward service scope, outcomes, and integration.

- This pricing pressure reflects:

- Digital transformation and automation in service delivery,

- Increased competition between providers,

- And more sophisticated buyers who can benchmark deals and demand value.

For U.S. organizations, the business case for outsourcing remains strong when the full cost of internal HR staff, HR systems, and compliance efforts is included in the comparison.

HR outsourcing and workforce technology insights

Cost is no longer the only story. The latest global surveys emphasise how outsourcing is becoming a platform for AI-enabled, data-driven HR.

Outsourcing inside the workforce ecosystem

Insights from a 2024 survey of more than 500 global executives indicate:

Organizations are orchestrating a “multidimensional sourcing” model, blending internal teams, outsourcing partners, global in-house centres, and digital workers.

Source: Deloitte

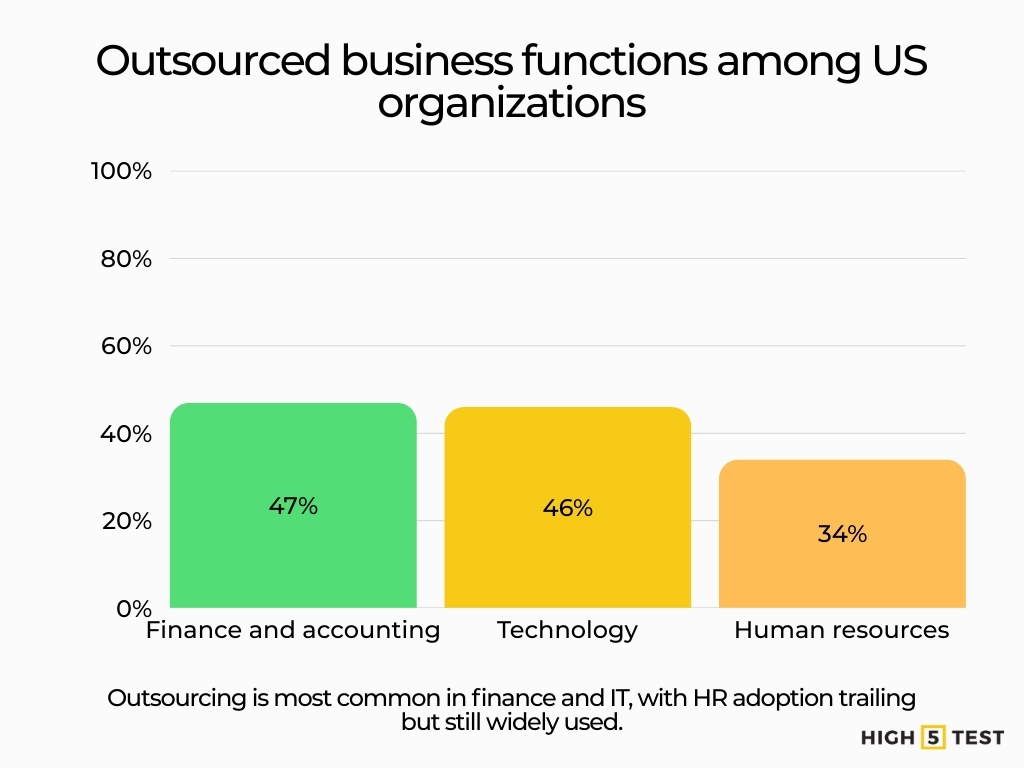

20% of the organizations surveyed are already developing a “digital workforce” strategy to manage such digital workers. This shows growing alignment between outsourcing and automation planning.

The report explicitly highlights the impact of AI and the extended workforce ecosystem on outsourcing decisions.

Source: Deloitte

Outsourcing is moving away from basic cost reduction agreements toward long-term partnerships that expand capabilities such as AI-based analytics, automation, and access to global talent.

Digitization as a growth driver

An HRO market analysis ties the forecast growth directly to digitization:

The USD 14.1 billion incremental growth in HRO from 2025 to 2029 is explicitly attributed to the digitization of HR functions, including AI, machine learning, and cloud-based platforms.

Source: Technavio

Cloud platforms and AI tools account for much of this expansion. HRO offerings now include analytics, compliance monitoring, and hiring automation. These features support scale without adding internal headcount.

Challenges and risk factors in HR outsourcing

Not all indicators are favorable; market research and academic work both identify risks that HR leaders must navigate.

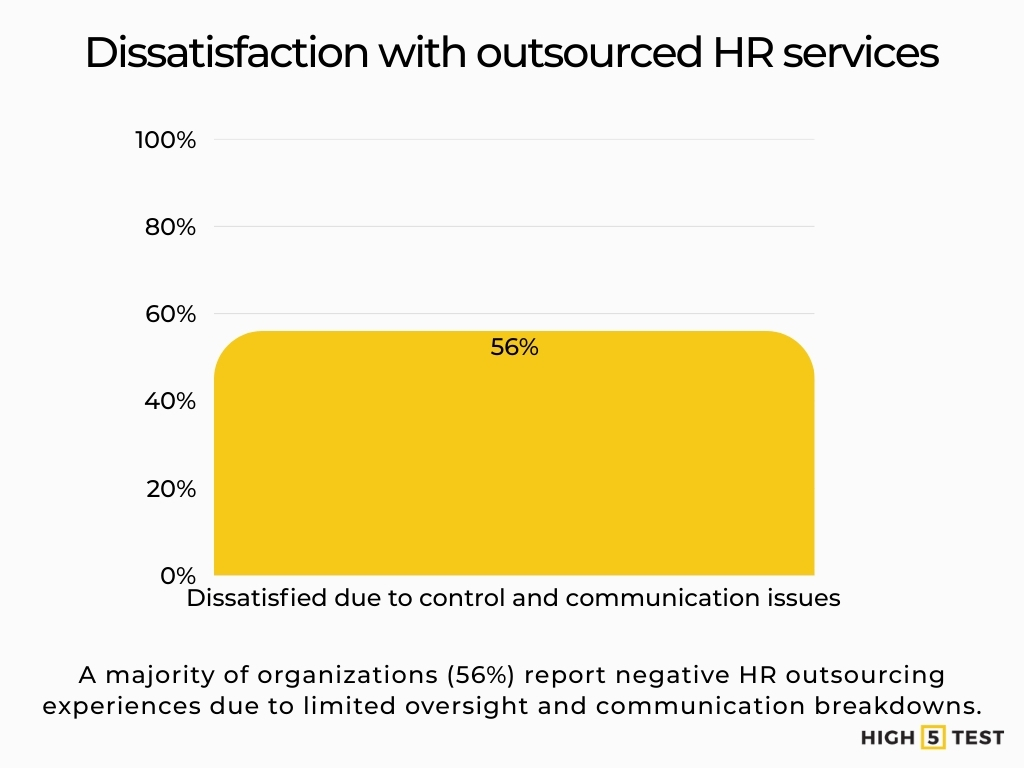

Dissatisfaction and control issues

A HRO report references a survey finding that:

56% of companies that have outsourced their HR functions reported dissatisfaction due to a lack of control and communication issues with service providers. Weak governance often drives poor outcomes.

Source: Technavio

This is a critical counterpoint to the positive satisfaction numbers in a previous report (93% satisfied overall with outsourcing). Taken together, they suggest:

- When outsourcing is well-governed, satisfaction is high.

- When governance, SLAs, and communication are weak, more than half of clients can experience dissatisfaction.

Outsourcing is a “double-edged sword”

Findings from a peer-reviewed 2024 study on emerging trends in human resource outsourcing indicate that:

- Decisions to outsource HR are strongly shaped by factors like flexibility, availability of resources, affordability, and acceptability.

- HR outsourcing is described as a double-edged strategy. It can enhance efficiency and focus, but also introduces dependency, quality, and control risks if not managed carefully.

Source: International Journal for Multidisciplinary Research (IJFMR)

For U.S. practitioners, this academic perspective reinforces the need for:

- Structured vendor selection,

- Clear KPIs and SLAs,

- Regular performance and risk reviews in outsourcing HR functions.

What the HR outsourcing data indicates

Putting all the research together, the 2025+ outlook for U.S. HR leaders looks like this:

1. Market growth remains stable

Global HRO revenue grows from USD 47.2 million in 2025 to USD 72.4 million by 2033 (CAGR 5.491%). This reflects predictable demand rather than volatility.

The U.S. market itself rose from around USD 13.3 million to USD 19.5 million over the same period (CAGR 4.90%). Growth remains slightly slower than global averages.

Source: Cognitive Market Research

2. North America remains the value center

North America is the largest revenue-generating region for HR BPO in 2024.

Source: Cognitive Market Research

It contributes 44% of incremental global HRO market growth through 2029. This confirms the region’s central position in market direction.

Source: Technavio

3. Outsourcing adoption is high and still rising

72% of surveyed leaders have outsourced work, around 34% outsourcing HR-related work, and 93% reporting satisfaction.

Source: Wipfli

4. Pricing is trending downward for administration, but value expectations are rising

21% fee reductions over five years and 10% over three years for HR outsourcing administration.

Source: ISG

5. Technology and AI are the main growth drivers

Digitization of HR, cloud platforms, AI, and analytics are explicitly cited as drivers of the projected USD 14.1 billion growth in HRO between 2024 and 2029.

Source: Technavio

Conclusion

HR outsourcing in the United States shows structured and sustained growth. Market data confirms steady expansion, broad adoption, and falling administration fees. Technology integration now shapes most outsourcing decisions. Organizations that align governance, service scope, and digital capability are better prepared to manage workforce demands through 2025 and beyond.