Employee training and development in the U.S. is at a crossroads. After two years of record-high investment topping $100 billion, 2024 brought a slight pullback in budgets, but not in urgency. Engagement levels have sunk to a 10-year low, turnover remains a costly drain, and managers continue to be underprepared for leadership roles. At the same time, rapid advances in AI are reshaping job requirements, with most organizations scaling up technical and practical AI training to keep pace.

Companies are reallocating spend toward external content and career-driven learning, signaling a shift from cost containment to strategic investment in skills, leadership, and retention. The data shows a clear throughline: organizations that prioritize career development, onboarding, and team effectiveness not only perform better but are more confident in their ability to keep talent. The following research highlights the most striking statistics and trends shaping training and employee development in 2024–2025.

10 most interesting employee training statistics for the US (2024/2025)

- Employee engagement crisis – Only 31% of U.S. employees were engaged in 2024, the lowest level in a decade.

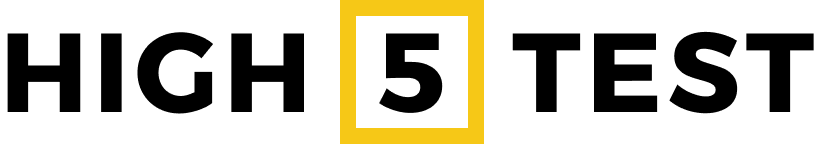

- Turnover is brutally expensive – Replacing an employee costs employers on average 33.3% of base salary, making retention strategies like training and team building directly tied to ROI.

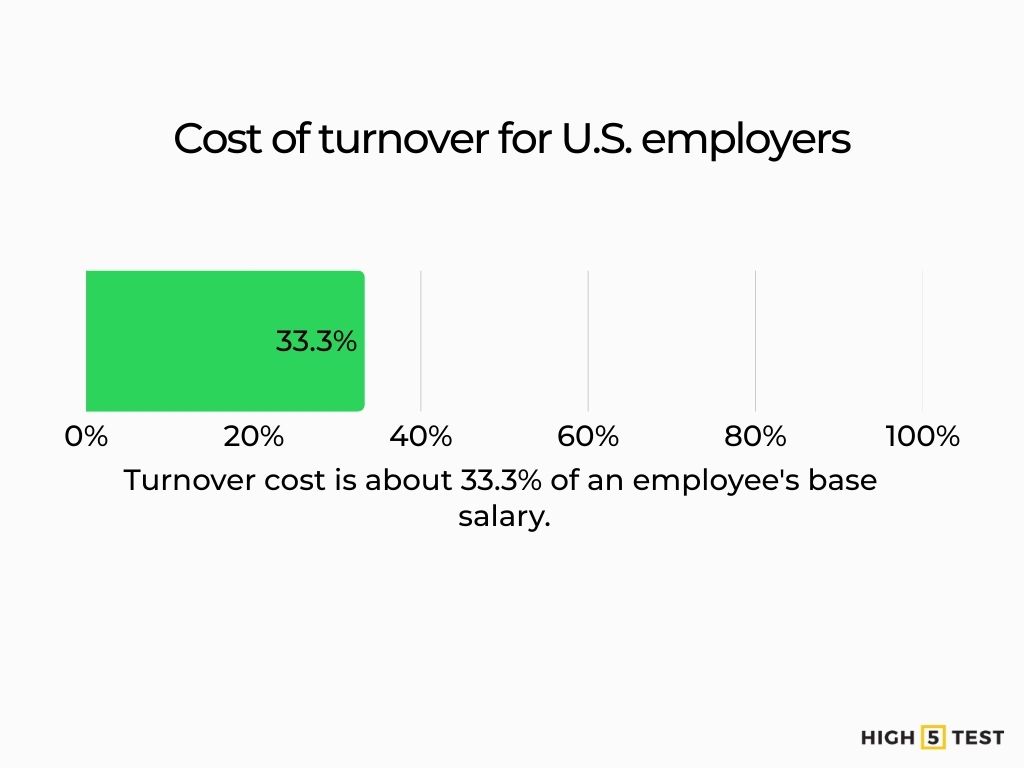

- Training market pullback after historic highs – Corporate training spend fell from $101.8B in 2023 to $98B in 2024 (–3.7%), even as external content and service spend surged +23% to $12.4B.

- Unit costs are rising fast – Direct learning cost per hour hit $165 in 2024, up 34% YoY, despite overall budget tightening.

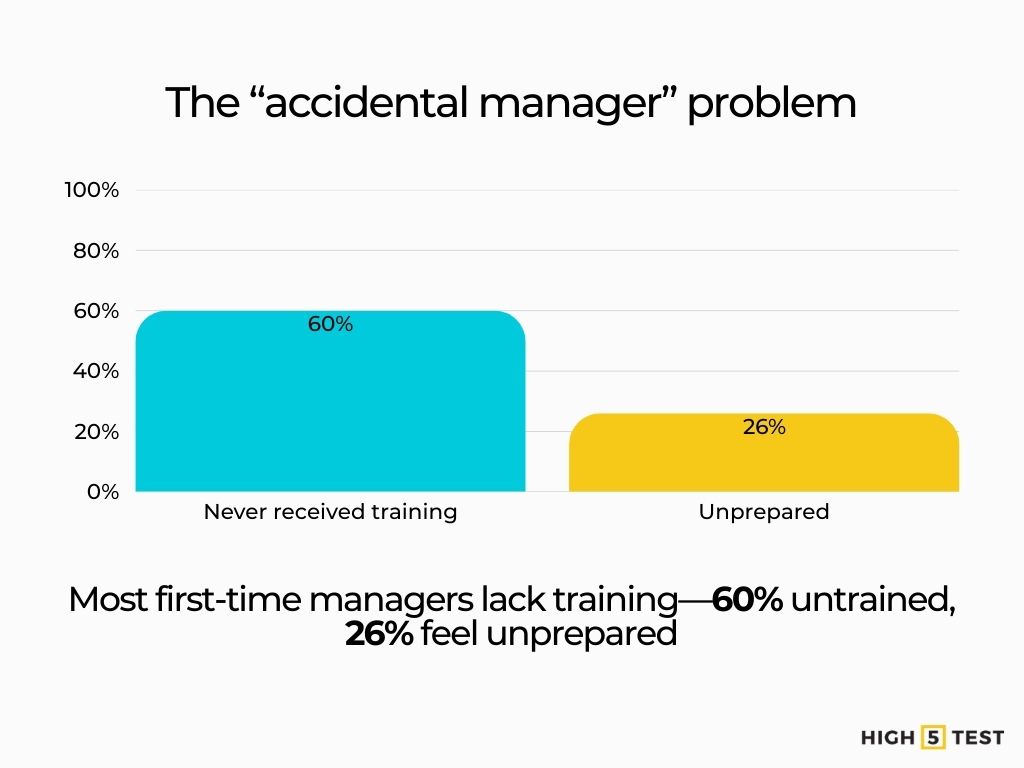

- Leadership training gap – Almost 60% of first-time managers never received management training, and less than half of managers overall are formally trained—yet 70% of team engagement variance is attributable to the manager.

- Onboarding is make-or-break – 1 in 3 new hires start looking for another job soon after joining due to poor onboarding, while structured onboarding accelerates productivity and boosts retention.

- AI adoption is exploding – AI usage in L&D stacks nearly tripled, from 9% in 2023 to 25% in 2024. Additionally, 55% of organizations already provide AI skills training, with over 60% planning to expand it.

- Career development = retention – Career Development was the #1 controllable reason employees left jobs (17.5%) in exit interviews. Organizations strong in career development are 32% more likely to deploy AI training and significantly more confident in profitability, attraction, and retention.

- Generational expectations are shifting – 53% of Gen Z (vs. 37% of older cohorts) say learning helps them explore career paths at their company. Strikingly, only 6% of younger workers list reaching a leadership position as their primary career goal.

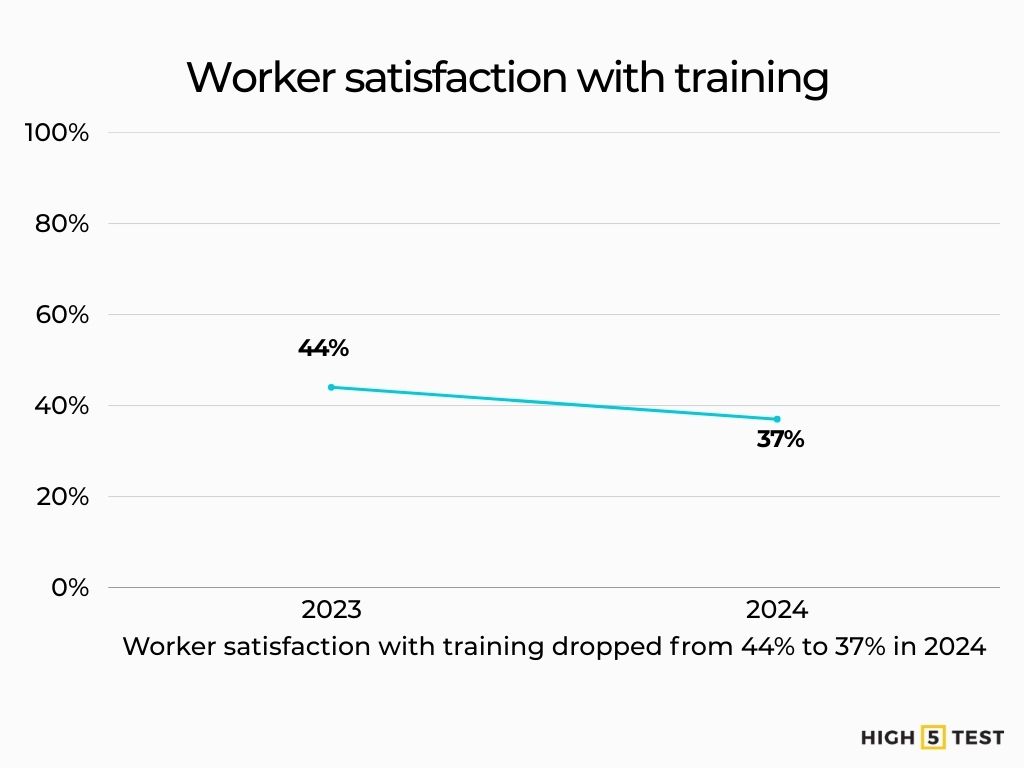

- Training satisfaction slipping – Only 37% of U.S. workers in 2024 reported being highly satisfied with their training and skill-development opportunities, down from 44% in 2023, despite 84% of employees saying that learning gives their work more purpose.

Statistical importance of employee training and development

Engagement headwinds are real. U.S. employee engagement fell to a 10-year low in 2024 (31% engaged), underscoring the need for intentional programs that build team connection, clarity, and collaboration.

Source: Gallup

Team effectiveness hinges on psychological safety. There is strong evidence that creativity, learning, and exploration increase when psychological safety is higher—exactly the outcomes team-building and manager training aim to cultivate.

Source: Harvard Business Review

Career development and retention are linked. Organizations that prioritize career development (“career development champions”) are more confident in their ability to retain qualified talent; 83% say they will maintain or increase investment in career-driven learning this year. These initiatives typically include leadership, collaboration, and cross-functional programs that strengthen team performance.

Source: LinkedIn Business Solutions

Turnover is costly. The rising cost of turnover for U.S. employers is about 33.3% of an employee’s base salary, reinforcing the ROI case for programs that improve team cohesion and manager effectiveness.

Source: Work Institute

Stats on employee training budget and expenditure trends

Per-employee and unit costs. In 2024, direct learning spend per employee is at $1,254 (down from $1,283 in 2023), and an average $165 cost per learning hour used (up 34% YoY) – evidence of unit-cost pressure even as many budgets hold steady.

Source: Association for Talent Development

2025 budget direction. Looking ahead, 83% of organizations say they will maintain or increase career-driven learning investment in 2025, indicating resilience in strategic training categories (leadership, collaboration, internal mobility) despite cyclical pressure.

Source: LinkedIn Business Solutions

Spend mix is shifting. In 2024, companies decreased total payroll for training staff and “other” costs (travel, facilities, equipment) but increased spend on outside products and services (e.g., content, providers) by 23% to $12.4 billion, signaling more reliance on external solutions.

Source: Training Magazine

Stats on total U.S. corporate training expenditure (annual trend)

2022: $101.6B (first time the market surpassed $100B).

Source: Training Magazine

2023: $101.8B (essentially flat YoY, +0.2%).

Source: Training Magazine

2024: $98.0B (–3.7% YoY), with $60.6B in training payroll (–4%), $12.4B on outside products/services (+23%), and $25.0B in other costs (down from $28.7B).

Source: Training Magazine

What this means: Even with a 2024 pullback, the market remains near historical highs. Organizations are reallocating toward scalable, externally sourced learning and doubling down on career- and team-centric programs in 2025 to counter engagement and retention risks.

Stats on employee training costs and budgets

1. Average training cost per employee

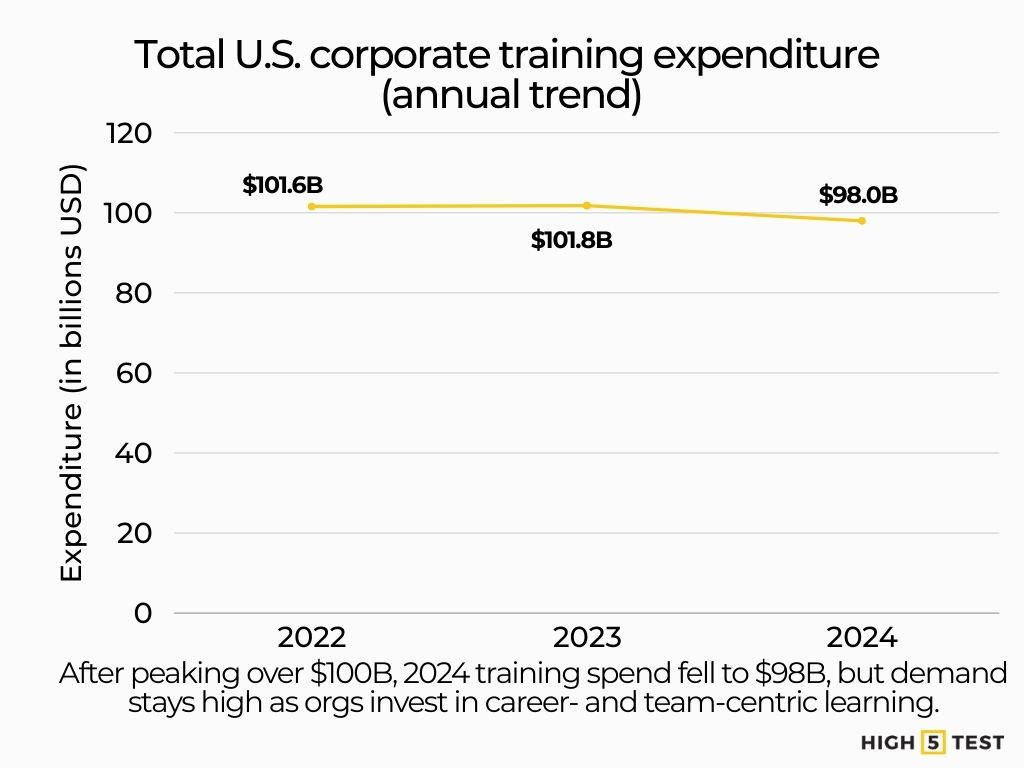

According to a recent analysis, U.S. companies spent an average of $774 per learner in 2024, down from $954 in 2023.

Source: Training Magazine

An average direct expenditure of $1,054 per employee, representing a modest decline from previous years.

Source: Association for Talent Development

Summary: The training cost per employee in 2024 ranged between $774 (overall average) and $1,054 (direct spend metric), depending on measurement context.

Training budget by company size

Large companies (10,000+ employees): average annual training spend dropped from $16.1 million in 2023 to $13.3 million in 2024.

Source: Training Magazine

Midsize companies (1,000–9,999 employees): training spend increased from $1.5 million to $1.7 million.

Source: Training Magazine

Small companies (100–999 employees): budgets dropped from $459,177 to $374,207.

Source: Training Magazine

Summary: In 2024, large enterprises scaled back training investment, midsize firms increased, and smaller organizations reduced budgets—reflecting strategic consolidation in training spending priorities.

Training budget by industry

While comprehensive breakdowns are limited for 2024, here’s what’s available:

In 2023, the average training spend per employee by industry:

- Service organizations: $1,512

- Retail and wholesale: $1,299

Source: Training Magazine

Employee training time and delivery modalities

Average training hours per employee (annual)

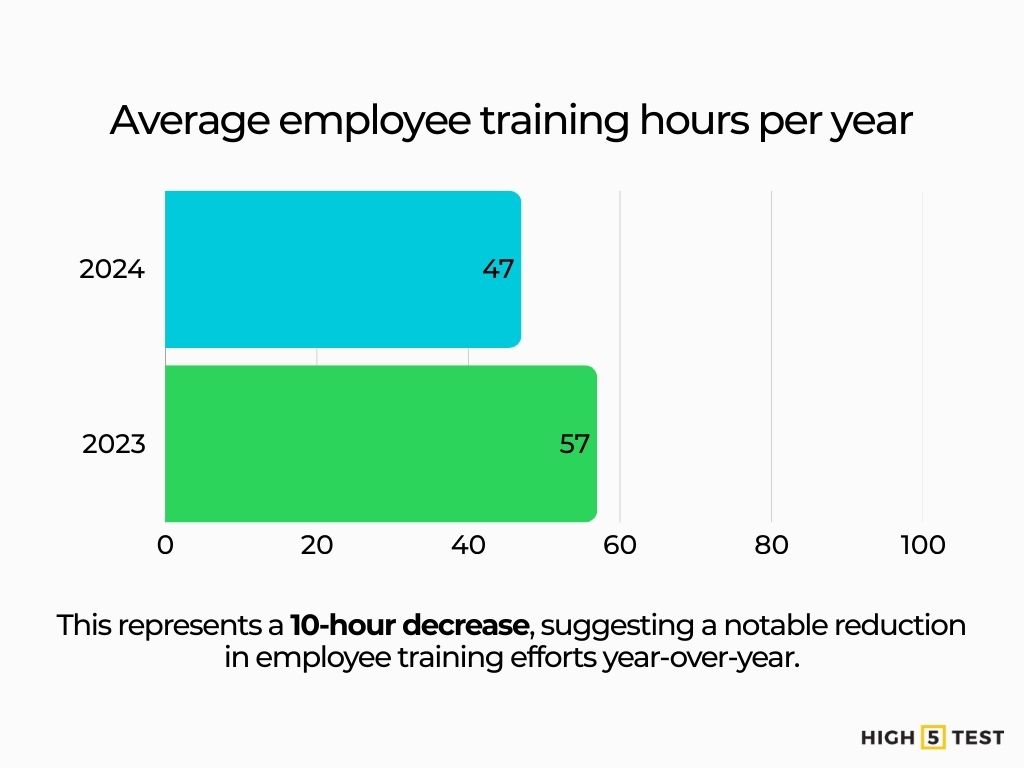

In 2024, employees received an average of 47 training hours per year, down from 57 hours in 2023, as companies reassess training formats and priorities.

Source: Training Magazine

Training hours by company size

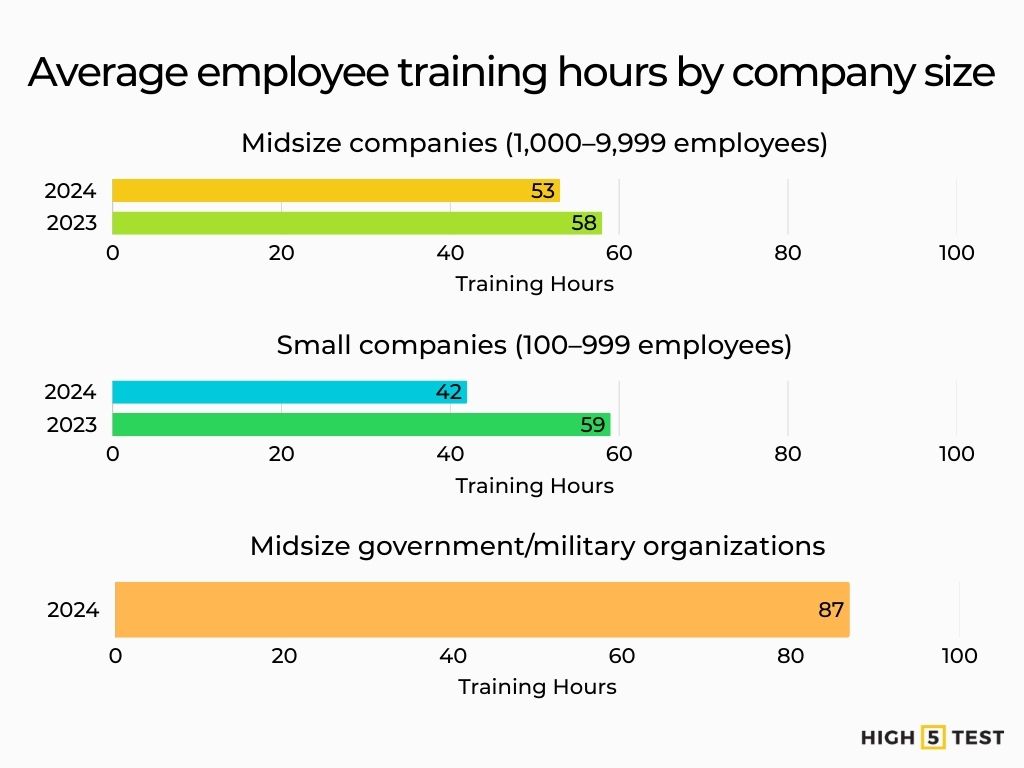

Midsize companies (1,000–9,999 employees): 53 hours in 2024, down from 58 in 2023 (≈ –10%).

Source: Training Magazine

Small companies (100–999 employees): 42 hours in 2024, down from 59 in 2023.

Source: Training Magazine

Midsize government/military organizations: The highest: 87 hours on average.

Source: Training Magazine

| Category | 2024 | 2023 (for comparison) |

| Avg. training hours/employee | 47 hours | 57 hours |

| − Small companies | 42 hours | 59 hours |

| − Midsize companies | 43 hours | 48 hours |

| − Manufacturing/distribution | 64 hours (highest) | – |

Training hours by industry

Manufacturers/distributors provide the highest average overall at 64 hours.

Source: Training Magazine

Stats on training delivery methods and modalities

Instructor-Led Training (ILT) vs. Virtual Instructor-Led Training (VILT)

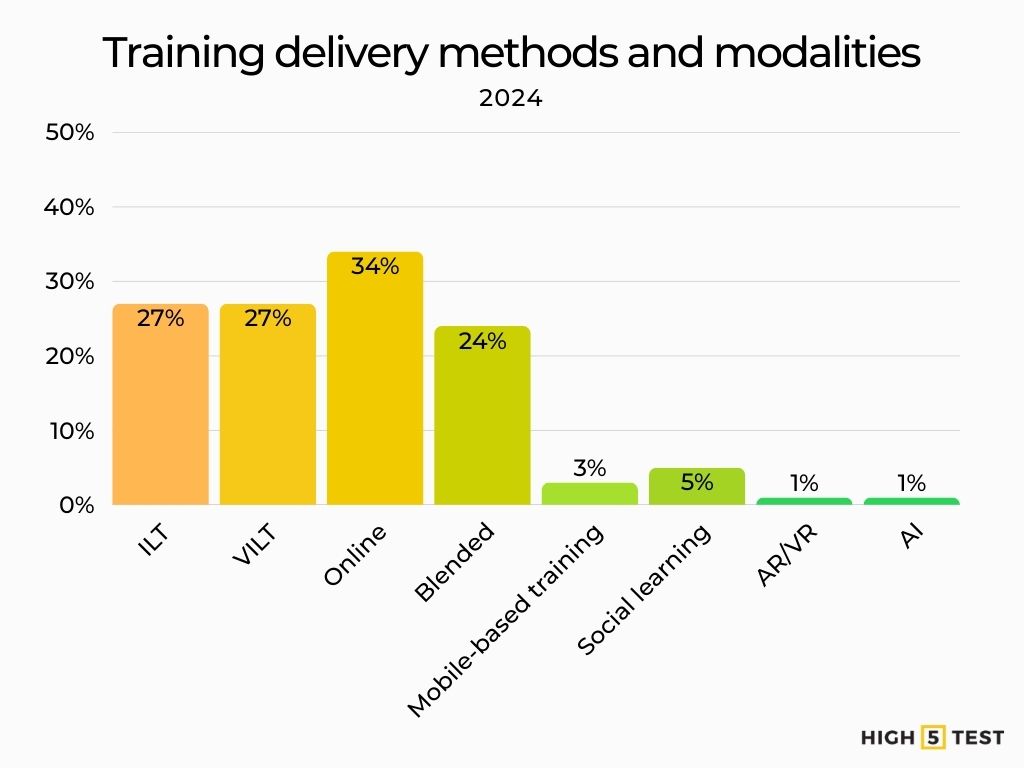

ILT (classroom-based): accounted for 27% of training hours in 2024 (down from 30% in 2023).

Virtual/instructor-led (VILT / webcast): also comprised 27% of hours, a slight drop from 28%.

E-Learning and self-paced online training

Online/computer-based learning: the most used mode at 34% of training hours (up slightly from 33% in 2023).

Blended learning approaches

Blended formats (mix of ILT and digital): 24% in 2024, down significantly from 32% in 2023.

Mobile Learning and microlearning trends

Mobile-based training: only 3% of hours (down from 4% in 2023).

Social learning: accounted for 5% (down from 6% last year).AR/VR and AI: each under 1%, but showing slight growth for AI.

| Delivery Methods (% of training hours) | ||

| − Online / Computer-based | 34% | 33% |

| − Instructor-Led Training (ILT) | 27% | 30% |

| − Virtual Instructor-Led (VILT/Webcast) | 27% | 28% |

| − Blended Learning | 24% | 32% |

| − Mobile Learning | 3% | 4% |

| − Social Learning | 5% | 6% |

| − AR/VR | ~0.3% | ~0.3% |

| − AI | ~0.8% | <0.8% |

Source: Training Magazine

Training delivery today, ROI, and learning tech (2024–2025)

Remote vs. in-person training trends

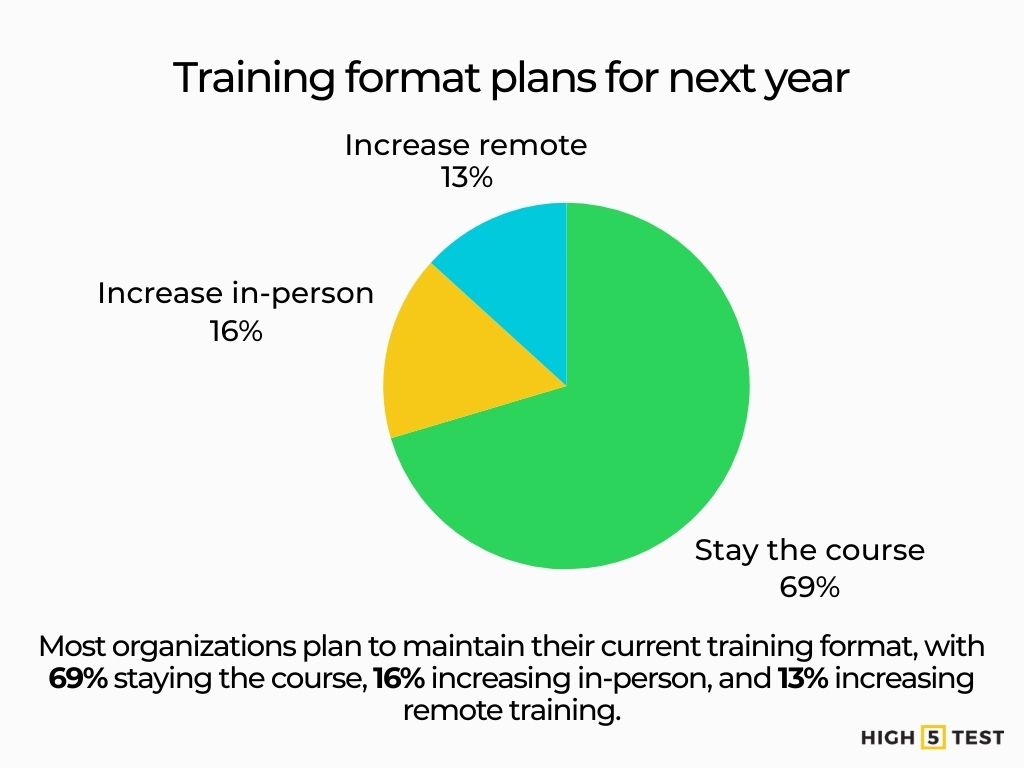

Most organizations are holding steady on format mix. For the next year, 69% plan to “stay the course” on their split between in-person and remote training; 16% plan to increase in-person, and 13% plan to increase remote.

Source: Training Magazine

Selective return to the classroom. Companies are shifting some topics back to face-to-face—especially management/supervisory (46%), onboarding (41%), and interpersonal skills (35%)—while 28% did not reinstitute any in-person training.

Source: Training Magazine

What’s actually used, by hours: online/computer-based 34%, VILT/webcasting 27%, in-person ILT 27%, blended 24% (with mobile 3%, social 5%). AR/VR each ~0.3%; AI ~0.8% as a primary delivery method.

Source: Training Magazine

Employee preferences: remote vs. classroom training

Flexibility wins, but a sizeable cohort still wants the classroom.54% of U.S. workers preferred flexible methods (e-learning, VILT, hybrid), while about one-third preferred live, instructor-led classroom.

Source: Association for Talent Development

Modality varies by content. Compliance training is mostly online (91% do at least some online; 48% entirely online). Exec development is the least online-heavy (40%).

Source: Training Magazine

Comparing the effectiveness of remote vs. in-person learning

Effectiveness is context-dependent. A 2024–2025 comparative study in medical CPD found similar gains in intention to change behavior after in-person vs. online courses; no significant difference between formats.

Source: PubMed Central

Cost considerations: In certain implementations, virtual training has shown greater cost-effectiveness than in-person training.

Source: TeachFloor

Stats on training effectiveness and ROI metrics

Impact on employee performance and productivity

Career-driven learning correlates with a better business outlook. Organizations classified as “career development champions” are more confident in profitability (75% vs. 64%) and in attracting (71% vs. 58%) and retaining talent (67% vs. 50%) than others.

Source: LinkedIn Business Solutions

Observable outcomes: Companies with stronger career development see higher rates of engaged learners and promotions versus peers.

Source: LinkedIn Business Solutions

Return on Investment (ROI) of training programs

Measurement capability is still a gap. Only 56% of organizations say they can measure the business impact of learning today.

Source: Watershed

Measurement priorities are rising. For 2025, “increasing effectiveness” (30%) and “measuring impact” (16%) rank among the top resource priorities for L&D leaders.

Source: Training Magazine

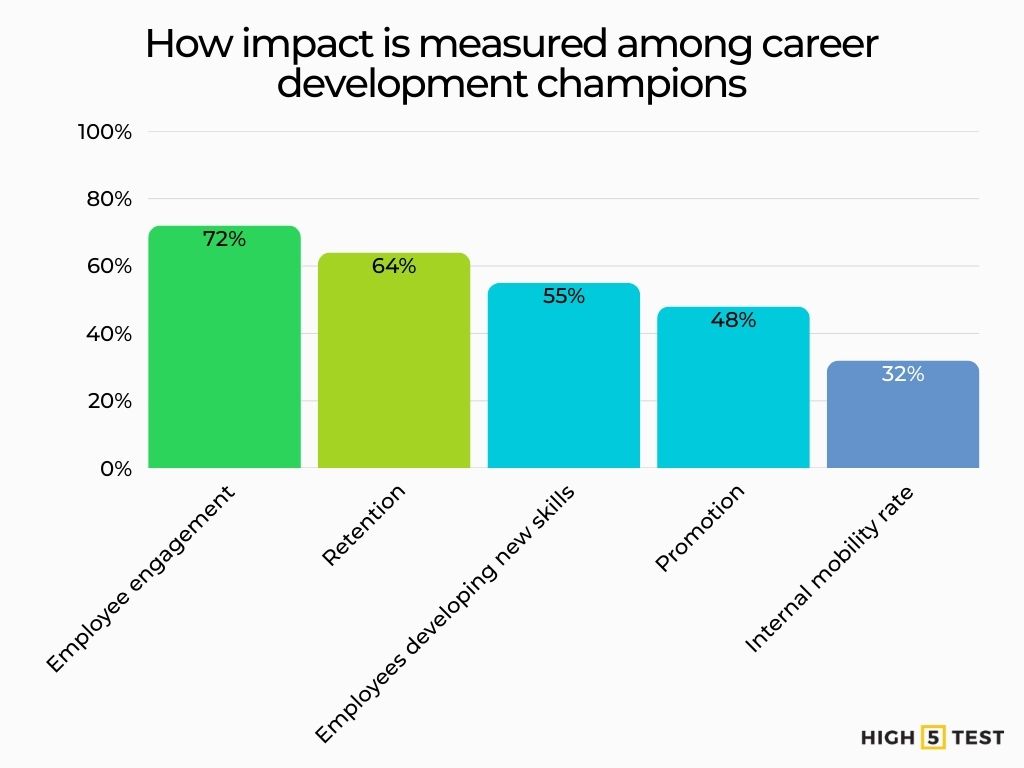

How impact is measured in practice: Among “career development champions,” the most common metrics are employee engagement (72%), retention (64%), employees developing new skills (55%), promotion (48%), and internal mobility rate (32%).

Source: LinkedIn Business Solutions

Training influence on employee retention and turnover

Career development is a core retention lever. In U.S. exit-interview data (2019–2023), Career Development was the #1 controllable reason for leaving (17.5%).

Source: Work Institute

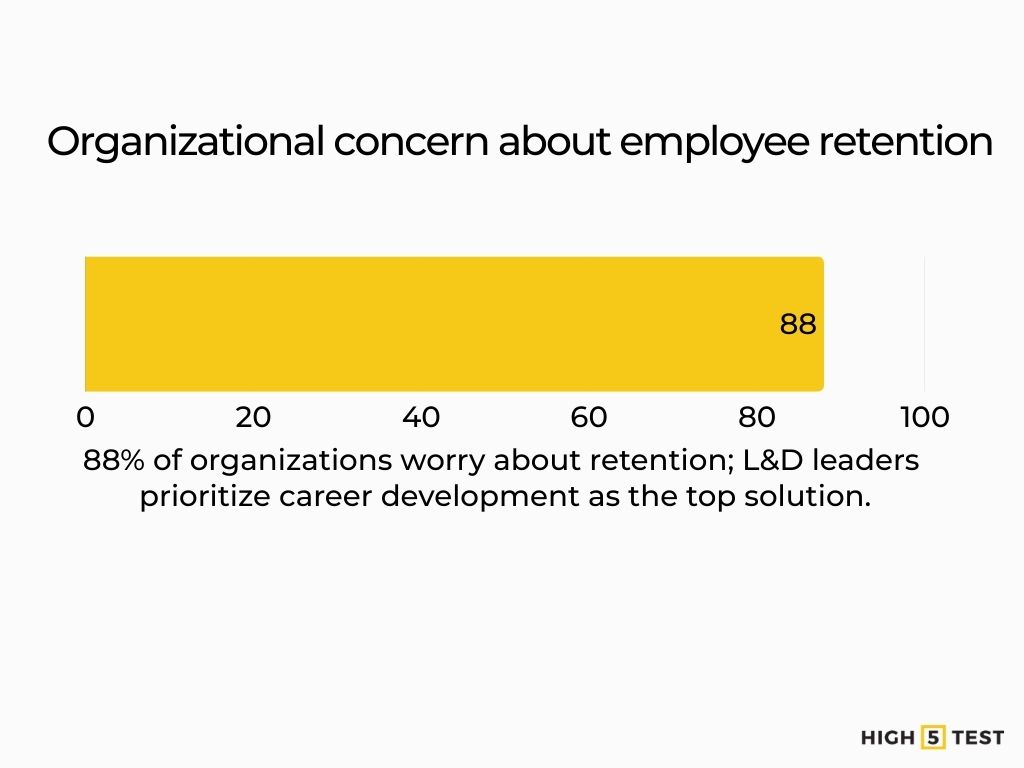

Leadership teams feel it. 88% of organizations are concerned about retention; investing in career development is the top retention strategy cited by L&D leaders.

Source: LinkedIn Business Solutions

Stats on learning technologies in employee training

Learning Management Systems (LMS) adoption and usage

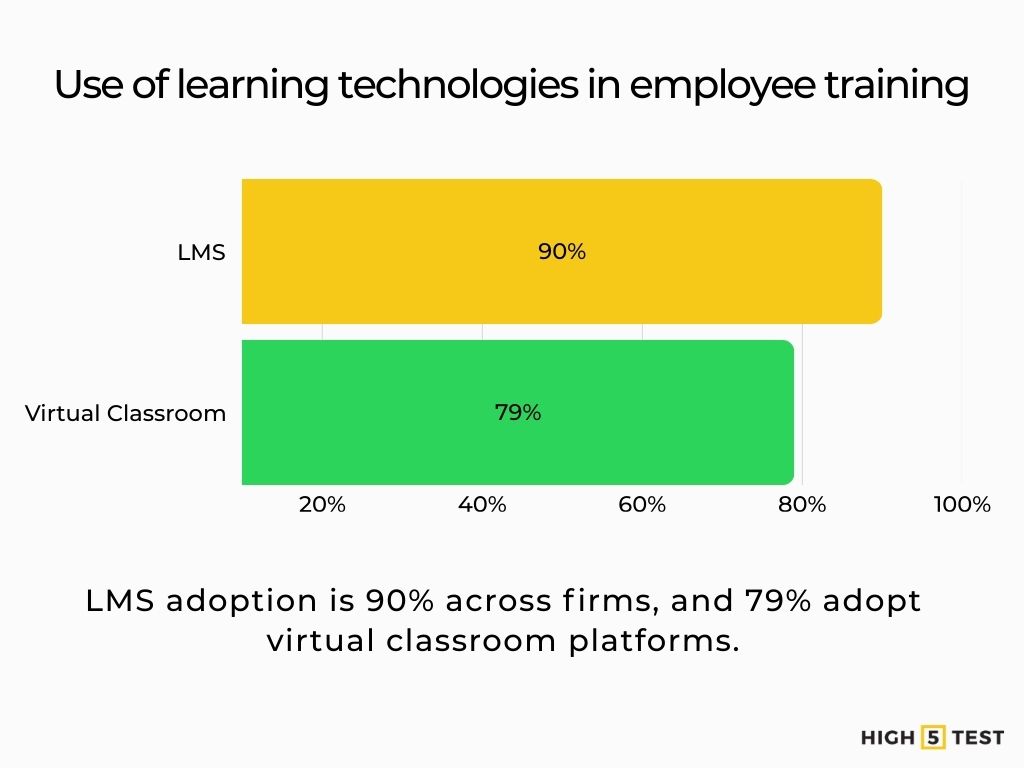

Near-ubiquitous LMS use. 90% of organizations report using an LMS (100% of large, 94% of midsize, 82% of small firms). Virtual classroom tools are used by 79%.

Source: Training Magazine

Operating model: 27% mostly or completely outsource LMS hosting, but LMS administration and learner support are handled in-house by 86%.

Source: Training Magazine

Gamification and game-based learning

Buying plans point to more games/simulations. The #1 anticipated purchase for the year ahead is games and simulations (46%), ahead of online tools/systems (39%).

Source: Training Magazine

Virtual Reality (VR) and Augmented Reality (AR) in training

Usage remains niche. As a technology, VR is used by 7% of organizations and AR by 4%; as a primary delivery method, both account for ~0.3% of hours.

Source: Training Magazine

Artificial intelligence and personalized learning

Rapid uptake in L&D stacks.AI usage in learning technology jumped from 9% in 2023 to 25% in 2024.

Source: Training Magazine

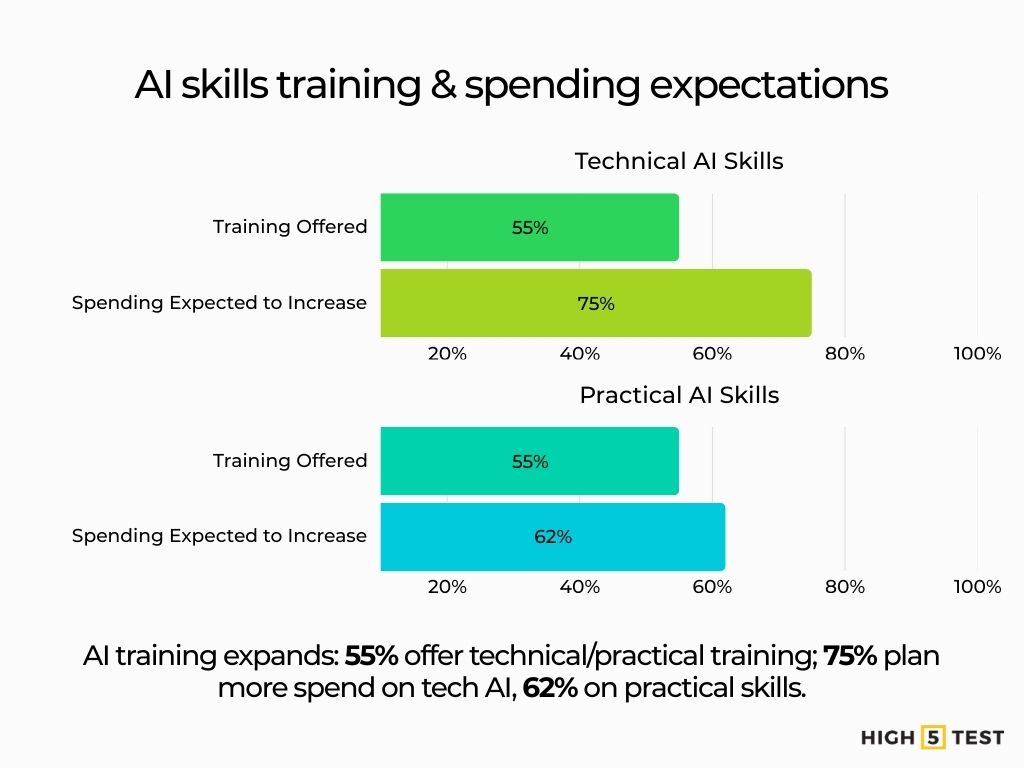

AI skills training is scaling. In 2024, 55% of orgs provided AI technical skills training, and 75% expect to increase AI spending; similar figures for AI practical skills (55% offered; 62% expect increases).

Source: Association for Talent Development

Learning analytics and data-driven training

Capabilities lag ambition. While interest in data & analytics continues to climb in global L&D sentiment surveys (2024–2025), many teams still struggle to evidence value at scale.

Source: Donald H Taylor

Where organizations are focusing: As noted above, measuring program effectiveness and usage are the top 2025 priorities, and engagement/retention are the most commonly used impact KPIs.

Upskilling, leadership, and compliance in employee training statistics

Upskilling and reskilling trends

AI + fast-changing skills: It is projected that ~70% of the skills used in most jobs will change by 2030, with generative AI a key catalyst. L&D leaders overwhelmingly rate human skills as increasingly important (91%). 84% of employees say learning adds purpose to their work, and 68% say learning helps them adapt during change.

Source: LinkedIn Business Solutions

Employees want more (formal) training: McKinsey finds nearly half of employees want more formal AI training to adopt the tech effectively.

Source: McKinsey & Company

Corporate upskilling initiatives and investment

AI-skills training is scaling: 55% of organizations offered AI technical skills training in 2024 (e.g., ML, programming) and 55% offered AI practical skills (e.g., prompt writing, AI ethics); ~62–64% expect to increase these offerings going forward.

Source: Association for Talent Development

Career-development champions act: Companies strong in career development are 32% more likely to deploy AI training this year and emphasize leadership training, internal mobility, and mentorship. Leadership training is the #1 career practice: 71% of organizations offer it.

Source: LinkedIn Business Solutions

Employee demand for continuous learning opportunities

Upskilling drives retention and mobility: Workers likely to switch employers are nearly 2× as likely to cite upskilling in that decision (67% vs 36%). Only 46% say their employer provides adequate opportunities to learn new skills—highlighting latent demand.

Source: PwC

Learning culture signals matter: Employees see rising value in learning during change (up to 68% in 2025)—a cue for employers to make learning accessible, relevant, and measurable.

Source: LinkedIn Business Solutions

Leadership development and management training

Prevalence of leadership development programs

Leadership development is widespread: 71% of organizations offer leadership training.

Source: LinkedIn Business Solutions

New-manager training statistics and gaps

The “accidental manager” problem persists: Almost 60% of first-time managers never received training when transitioning into leadership; 26% felt unprepared. In 2024, Less than half of managers have received management training.

Source: Center for Creative Leadership, Gallup

Outcomes and impact of leadership training

Career development equals better outcomes: Robust career development (leadership training, internal mobility, mentoring) links with stronger promotion outcomes and learner engagement. Meanwhile, manager support for learning dipped 5 percentage points from 2024, signaling the need to prepare managers as coaches.

Source: LinkedIn Business Solutions

Manager capability influences performance: 70% of the variance in team engagement is attributable to the manager, reinforcing ROI for leadership development.

Source: Gallup

Compliance training statistics and trends

Prevalence of mandatory compliance training

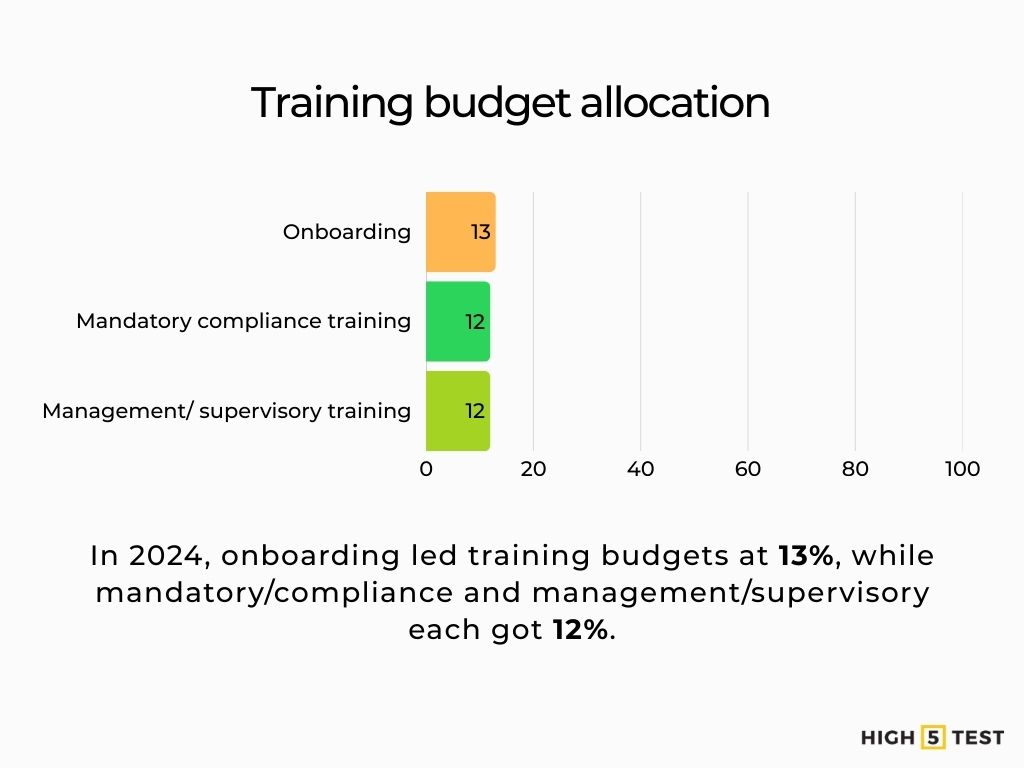

Budget share and focus: In 2024, organizations allocated 12% of training budgets to mandatory/compliance training (on par with management/supervisory at 12%; onboarding led at 13%).

Source: Training Magazine

Modality: 91% of organizations deliver some compliance training online, and 48% deliver it entirely online.

Source: Training Magazine

Time spent on compliance training (annual requirements)

Completion time pressure is real: One-third (33%) of compliance leaders say their programs take employees five or more hours to complete, with 46% under pressure to shorten training time.

Source: Ethena

Effectiveness and challenges of compliance training

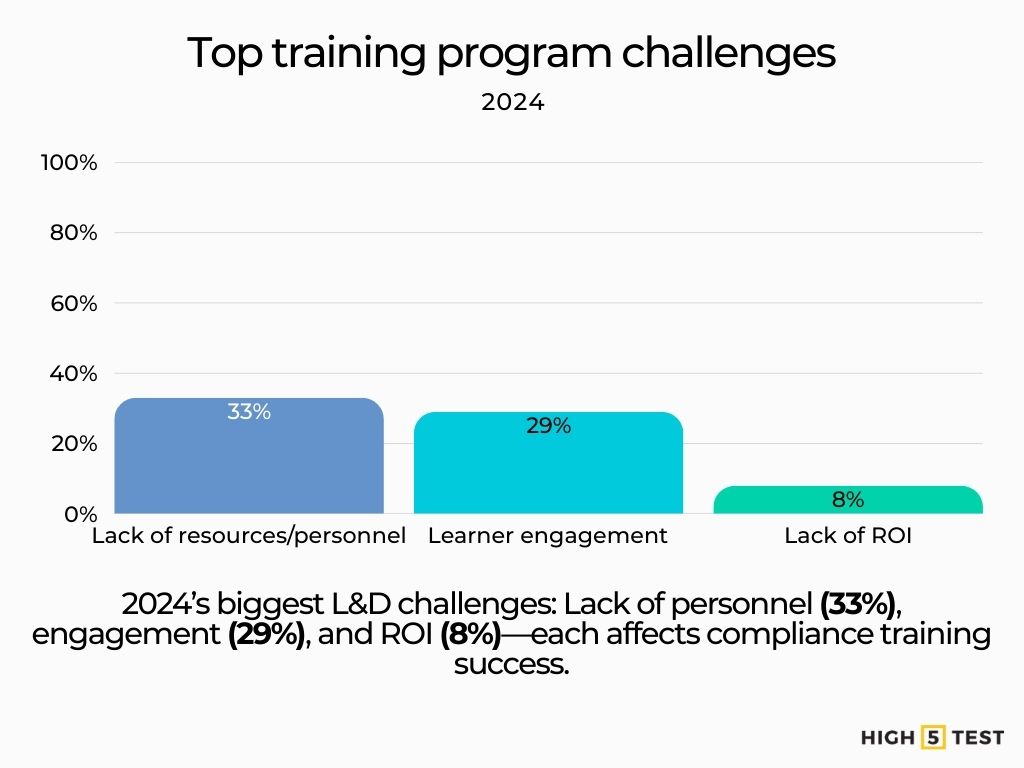

Top program challenges (post-pandemic lens): The biggest training challenges cited in 2024 were lack of resources/personnel (33%), learner engagement (29%), and lack of ROI (8%)—all of which affect compliance curricula too.

Source: Training Magazine

Why employees still slip: 87% of employees recently faced situations where they didn’t know how to comply—uncertainty, not malice, is the leading cause of noncompliance.

Source: Gartner

Stats on onboarding training for new hires

Adoption of structured onboarding programs

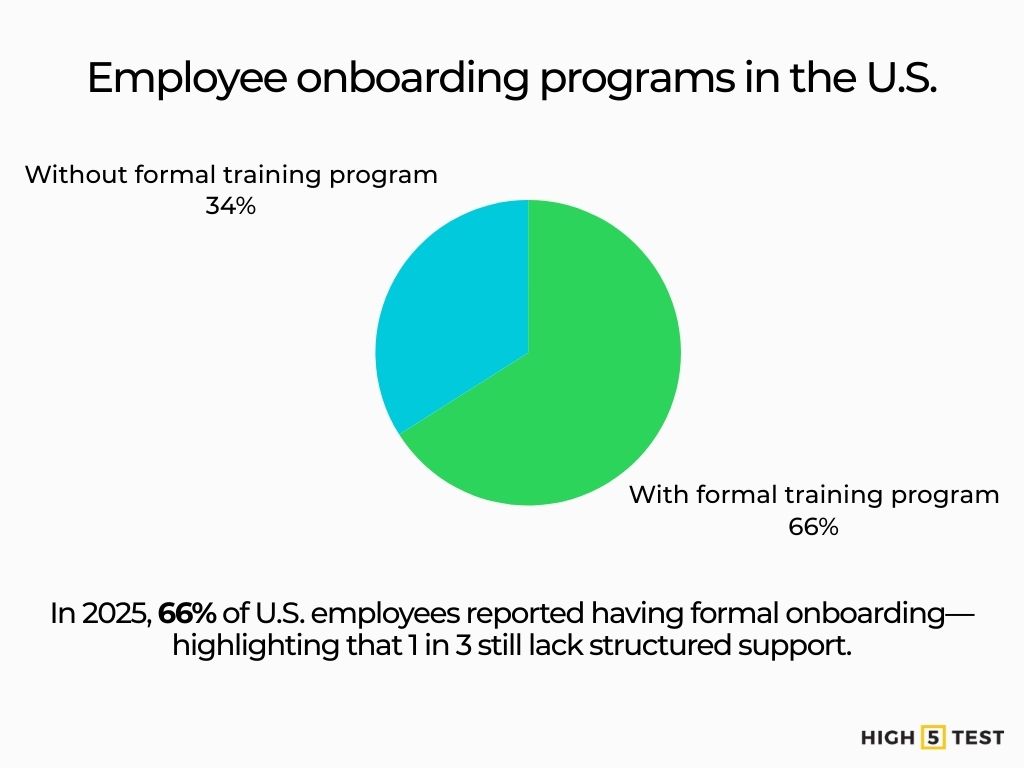

Formal programs are common but not universal. In 2025 round-ups of U.S. onboarding data, roughly two-thirds (66%) of employees say their employer had an official onboarding program—leaving a sizable minority without a structured experience.

Source: Talentech

Preboarding is rising. 65% of employees started onboarding before their official Day 1, signaling earlier, more coordinated hand-offs between TA and HR.

Source: Enboarder

Budget signals priority. U.S. organizations allocated the single largest slice of their 2024 training budgets to onboarding (13%), ahead of compliance and manager training.

Source: Training Magazine

Typical onboarding duration and content

The “first 90 days” focus. HR leader surveys and practitioner guidance in 2025 center on onboarding design around the first 90 days—linking clear milestones, manager hand-offs, and role enablement to early retention and ramp.

Source: Enboarder

What employees say an excellent program includes. There are five recurring components: connection & culture, manager involvement, memorable “wow” moments, and fit-for-purpose tech that streamlines tasks and nudges participation.

Source: Enboarder

Where delivery happens. As firms normalize post-pandemic, 41% brought onboarding back to some in-person delivery in 2024 (often blended with digital).

Source: Training Magazine

Impact of onboarding on retention and time-to-productivity

Poor onboarding triggers early attrition risk. 1 in 3 new hires said they began looking for other jobs soon after starting due to a poor onboarding experience.

Source: Enboarder

Investment in early development reduces quitting intent. Across the broader employee-development lens, workers who feel their employer is investing in their future skills are ~2× as likely to say they do not intend to leave (62% vs. 34%).

Source: ADP Research

Faster ramp and performance ties. Employers report that structured onboarding—especially when manager-led and milestone-based—accelerates new-hire effectiveness and productivity (frequently paired with role-specific training and coaching).

Source: Enboarder

Employee sentiment on training and development

Employee satisfaction with training and development opportunities

Satisfaction is mixed and slipped in 2024. 37% of U.S. workers said they’re extremely/very satisfied with their training and skill-development opportunities in 2024, down from 44% in 2023. 70% say they currently have the training they need to advance; 30% say they need more.

Source: Pew Research Center, Pew Research Center

Training as a factor in engagement and retention

Learning is a top retention lever. In 2024, 90% of organizations were concerned about retention, and “providing learning opportunities” ranked as the No.1 retention strategy.

Source: LinkedIn Business Solutions

Learning fuels purpose. In 2025, 84% of employees agree “learning adds purpose to my work,” underscoring its engagement effect when tied to career growth.

Source: LinkedIn Business Solutions

Upskilling pays off. 2025 workforce analytics show on-the-job upskilling correlates with higher wages and lower intent to leave, reinforcing the business case for continuous development beyond Day 1.

Source: ADP Research

Generational differences in learning expectations

Gen Z is growth-hungry. 53% of Gen Z (vs. 37% of older cohorts) agree that learning helps them explore career paths within their company, so showing clear development pathways early in onboarding matters.

Source: LinkedIn Business Solutions

Career development is a draw. 2025 generational surveys again place learning and development among the top reasons younger workers choose (and stay with) employers. Only 6% say their primary career goal is to reach a leadership position

Source: Deloitte

Conclusion and future outlook

The 2024–2025 picture is clear: onboarding has become a budgeted priority, preboarding is standardizing, and the first-90-days playbook is where HR and managers win or lose new hires. At the same time, employees are discovering their career matches, and their expectations for career-linked learning are rising, especially among Gen Z, making it essential to connect onboarding to an ongoing development journey (skills plans, mentoring, internal mobility). Organizations that blend human connection, manager enablement, and data-informed nudges and visibly invest in people’s future skills are best positioned to cut early turnover and speed time-to-productivity in 2025.